Integrated Business Planning (IBP) is arguably the most comprehensive framework to manage planning across an organization.

Ultimately, IBP is the evolution of Sales & Operations Planning, which is a process deeply rooted into sales and supply chain operations. Many organizations therefore manage IBP from within Operations and avoid or disregard Finance participation. But that shouldn’t be the way. Why not? Well, IBP is not an operational process. When done right, IBP is a process to help the C-suite – particularly CEOs – to deploy strategy and make faster and better decisions. And because CEOs speak the financial language, IBP should be a Finance-led process.

With the above in mind, many organizations unsurprisingly fail to get the right level of sponsorship, and their IBP initiatives fail to deliver what they should. CEOs aren’t interested in partial or biased views of a plan. Instead, they expect IBP to help them compose a neutral view that drives business performance effectively. And that’s a succinct reason that CEOs will trust and support IBP.

How, then, can you get your CEO to trust the IBP process? This blog will dive into 5 considerations to help your CEO trust IBP.

5 Considerations to Help Your CEO Trust the IBP Process

Much has been written about the lack of executive support for IBP, but not much has been written about how an IBP initiative can win your CEO’s heart and mind. The following considerations can help:

- Anchor IBP to Finance metrics for P&L, Cashflow, and Return on Invested Capital. Finance metrics (e.g., EBIT or ROIC) make the IBP process effective. Therefore, organizations with mature IBP processes use key Finance metrics because they are the best value indicators and CEOs understand those metrics.

- Focus on the right time horizons. IBP is primarily a strategic planning process used to address long-term horizons (3-5 years). At the same time, it should also serve as a connector to the short-term plans and initiatives (1-2 years). Calibrating to the right time horizons is therefore a fantastic opportunity to connect IBP with the C-suite.

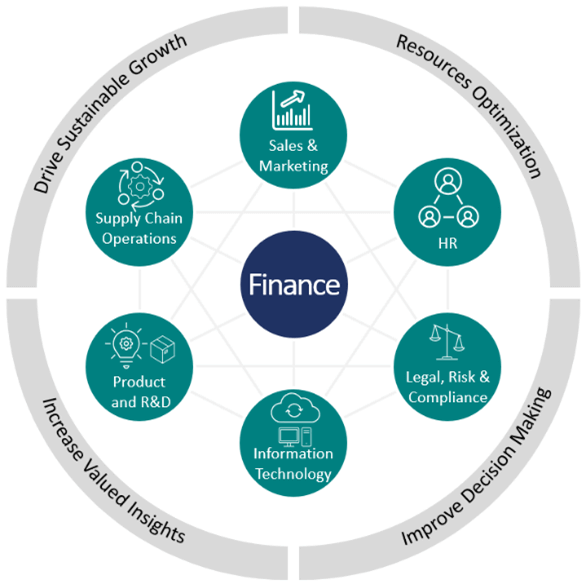

- Make it all-inclusive. IBP can include the Finance, Product, Demand, Supply and Support functions. Traditionally, S&OP connects Supply Chain with the Demand Generation and Sales teams. IBP expands to Finance and Product, but what about other functions that – for example – require workforce or CapEx planning? There’s no better presentation card than an all-inclusive IBP discipline to represent the holistic planning view of the organization that the CEO leads.

- Make IBP auditable and accountable. One of the main purposes of IBP is to foster collaboration and accountability. Thus, orchestrating and synchronizing becomes critical, and accountability must be well-defined at every step of the process. At the same time, data, numbers and assumptions must be auditable and traceable all the way up to financial statements and results. This capability will raise the CEO’s confidence in the numbers, insights and recommendations from the IBP team.

- Balance granularity versus insight. By focusing on the daily operational details, organizations can miss the bigger picture and fail to provide the appropriate insights for the leadership team. Given that, is it necessary to drill down to the part-number level? Does IBP really require daily information?

From Integrated Business Planning to Improved Business Performance

If you’ve reached this point in the post, you might be thinking that the five considerations above make sense. They aren’t trivial, however. In fact, they can be hard to achieve. How, then, do you get there?

IBP is ultimately about deploying the company strategy through structured and cohesive planning across the organization. And the considerations outlined in this post are difficult to achieve without the proper technology solution.

Often, technology during IBP implementations focuses only on reporting and visualization capabilities, disregarding other key capabilities. For instance, the capabilities below might be disregarded:

- Data management automation

- Data cohesiveness (one set of numbers)

- Data integrity and pedigree (anchored to financial metrics and artifacts)

- Adaptive and intuitive process workflows and approvals (auditable collaboration)

- Calibration between insights and detail

When the technology covers all these aspects, Integrated Business Planning becomes the right framework to improve business performance.

And unequivocally, modern EPM solutions are the best choice to bring all these capabilities together and establish an IBP process that serves a purpose for the CEO and C-suite.

All Things Considered…

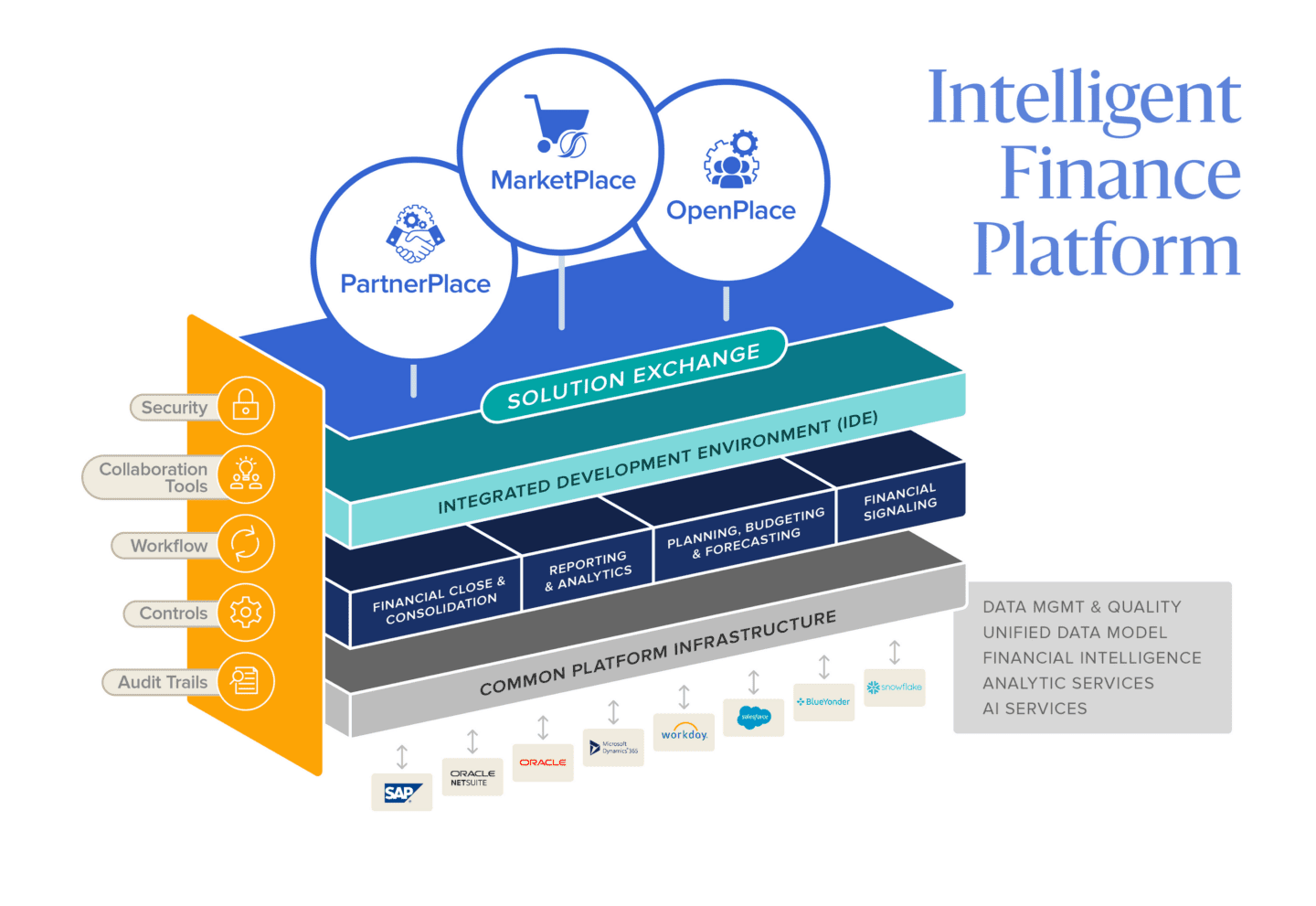

IBP done right is ultimately a Finance-driven process. And OneStream’s Finance Platform is the only market solution capable of providing every single mission-critical process for Finance. Need proof? Look no further than Autoliv, a world-leading supplier in safety systems. Autoliv used OneStream and its unified data model approach to transform financial and operational planning to respond to market changes and make faster decisions.

In other words, the unified data model, data management and quality, financial intelligence, automation and analytical AI services in OneStream make it uniquely positioned to win your CEO’s heart and mind.

Learn More

Want to learn how you can maximize the benefits of your IBP process and get your CEO onboard, read our article on how to unify IBP and maximize the benefits.

Read the ArticleAs modern Finance leaders navigate the turbulent global landscape, the path ahead for Financial Planning & Analysis (FP&A) gets clearer every day. A pivotal shift is occurring, emphasizing the need to unify connected planning to foster alignment between Strategy, Finance and Operations. Not too long ago, however, the ambitious vision of integrating financial and operational planning into a seamless ecosystem faced setbacks due to technological limitations. The rapid advancements in planning processes outpaced the supporting technology – a predicament many businesses might recognize.

But here’s the truth: organizations now stand at a crossroads – embrace unified connected planning or risk incurring hidden costs.

Despite technological advances and increased data accessibility, Finance is still struggling to synthesize all planning across the enterprise into one cohesive and ongoing process. In fact, according to a 2023 report from the American Productivity and Quality Center (APQC), only 26% of CFOs surveyed say their respective company’s approach to annual budgeting is valuable. Plus, even the CFOs themselves admit that improvements are needed

Today’s Finance leaders must maintain board, investor and stakeholder confidence while providing actionable insight to line-of-business managers. To do so, CFOs and Finance managers must, now more than ever, deliver fast, accurate and valuable financial and operational information that can be trusted.

Finance leaders can now leverage modern technology to rid themselves of legacy systems and processes while embracing future trends prevalent in today’s market.

Key Trends Shaping Modern FP&A

Spurred by technological advances, the speed of analytical disruption in organizations is already perpetually fast – and only getting faster. As Finance groups prepare for the transformation ahead, 3 key trends are reshaping the future of how organizations will generate value from reporting and analytics initiatives:

Key Trend #1: The Rise of eXtended Planning & Analysis (xP&A)

As Finance teams respond to a rapidly changing business environment, FP&A is extending its reach to include and collaborate with Sales, Marketing, Supply Chain, Talent Management and IT to accelerate enterprise agility. This unifying framework – known as eXtended Planning and Analysis (xP&A) – enables continuous collaboration and performance management by using a single, composable platform and architecture.

Key Trend #2: More Targeted Analytics

Financial analysts and decision-makers are drowning in complex data. To better process that data, organizations are increasingly enhancing traditional dashboards with dynamic data-driven insights powered by artificial intelligence (AI) and machine learning (ML). The resulting dynamic data stories generate insights as narratives, highlighting the most meaningful changes in the business for each user – with root causes, predictions and prescriptions for the roles and contexts. In turn, the enhanced data-driven insights reduce the risk that financial and operational analyses will be misinterpreted.

Key Trend #3: AI-Enabled FP&A

The way Finance teams manage the data behind dashboards and visualizations is changing. How? Finance can use modern technologies to deploy a host of new models and tools to provide actionable financial and operational data that drive effective decision-making. More specifically, technologies such as ML and AI are leveraged to automate various tasks required during the analytics process – and to discover, visualize and narrate important findings in vast data sets. AI and ML ultimately enable Finance to reduce the time it takes to perform the day-to-day input- and output-focused activities that consume analysts’ time – without requiring the full-time support of data scientists. (See Figure #1)

As organizations navigate the ever-evolving landscape, staying ahead of the curve is paramount to success. While the adoption of modern technologies and embracing key trends can bolster an organization’s financial agility, there comes a crucial juncture when scaling connected planning becomes imperative. Recognizing the signs that indicate the right time for this strategic move can make all the difference in propelling a company towards its goals and sustaining growth.

5 Signs It’s Time to Scale Connected Planning

The continuous sophistication of organizations makes it challenging to harness technology to bolster Finance. When those challenges are coupled with the pressures of volatile revenue streams, Finance leaders are tasked with managing growth, optimizing emerging technologies, addressing globalization demands, evolving target operating models and empowering mobile employees. These leaders must also explore innovative avenues to boost productivity, optimize costs and maximize the value of relationships.

If your organization is evaluating whether it’s ready for Finance Transformation, here are 5 key signs it’s time to scale connected planning.

Sign #1 Increasing Complexity and Data Volume

One clear indicator that it’s time to scale your connected planning efforts is when your organization experiences a significant increase in complexity and data volume. As the business grows, you’ll likely encounter more intricate planning challenges that cannot be effectively addressed with traditional planning methods. Instead, scaling your connected planning capabilities will allow you to leverage advanced analytics and data integration to handle complex planning scenarios, accommodate large data sets and gain deeper insights into business operations.

Sign #2 Lack of Coordination and Collaboration

Disconnected FP&A planning processes often result in silos, leading to a lack of coordination and collaboration between different departments. If you notice your teams are struggling to work together, duplicate efforts or encounter difficulties aligning plans, those signs are a clear indication you need to scale your connected planning efforts. By implementing an integrated planning solution, you can break down departmental barriers, encourage cross-functional collaboration and ensure everyone is working toward a shared set of goals.

Sign #3 Inefficient Planning Cycles

Are planning cycles taking longer than necessary, causing delays in decision-making and hampering your ability to respond swiftly to market changes? If so, those signals are telling you the time is now to scale your connected planning efforts. Automating and streamlining your planning processes through connected planning will reduce manual work, eliminate redundant tasks and significantly speed up your planning cycles. In turn, this increased efficiency allows you to make informed decisions faster and stay ahead of the competition.

Sign #4 Inaccurate Forecasts and Poor Performance

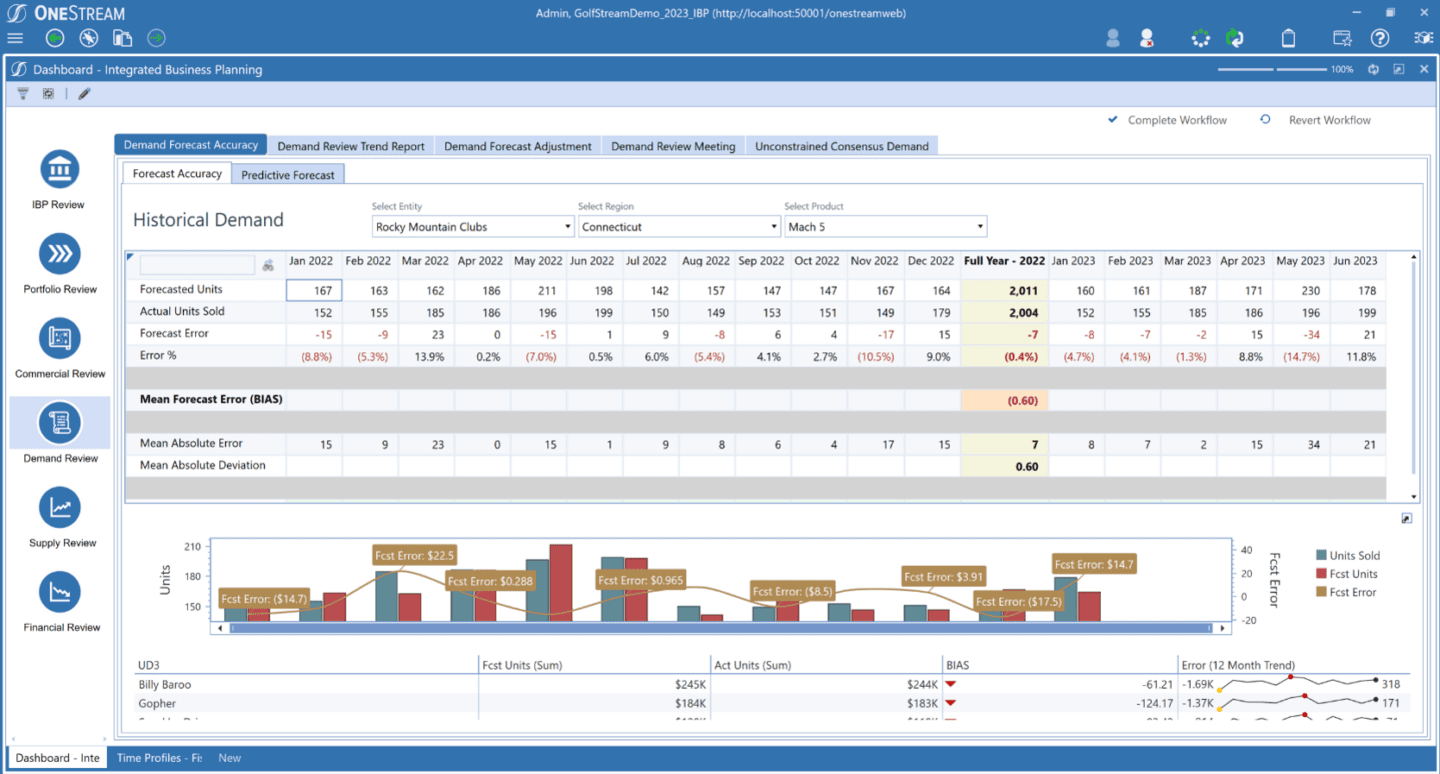

If your FP&A organization is consistently struggling with inaccurate forecasts or failing to meet performance targets, your planning processes may be falling short. (See Figure #2) Scaling connected planning can help you improve forecast accuracy by leveraging real-time data and advanced forecasting models. With access to up-to-date information and robust predictive capabilities, you can make more reliable projections, identify potential risks and opportunities, and take proactive measures to achieve better performance outcomes.

Sign #5 Limited Scalability and Adaptability

As your business expands and evolves, you need planning processes that can scale and adapt accordingly. Traditional FP&A planning methods often lack the flexibility to accommodate growth or respond effectively to market shifts. scaling connected planning enables you to handle increased demand, seamlessly integrate new business units or acquisitions, and adjust your plans to align with evolving market dynamics. Scaling therefore provides the scalability and adaptability needed to support your organization’s long-term growth strategy.

Conclusion

Connected planning is a powerful approach that can revolutionize how your organization manages its planning processes. Recognizing the signs that it’s time to scale your connected planning efforts is crucial for staying competitive in today’s fast-paced business environment. And by addressing increasing complexity, fostering collaboration, improving efficiency, enhancing forecast accuracy and enabling scalability, you can unlock the full potential of connected planning and propel your organization toward greater success. Embrace the opportunity to scale connected planning, and watch your business thrive in the face of changing landscapes.

Learn More

To learn more about how organizations are scaling connected planning, click here to read our whitepaper on the topic. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions and start your Finance Transformation, let’s chat!

Strategic workforce planning is crucial for business leaders today. Why? Because the labor market is facing unparalleled forces of change: demographic upheaval, talent scarcity, evolving employee preferences when choosing an employer, and the ubiquitous and growing presence of artificial intelligence.

Running strategic workforce planning together with Finance in one unified solution is a best practice that ensures people plans align with strategic and financial objectives.

In fact, unifying workforce planning with both strategic and financial planning sets up organizations to thrive under unsettled market dynamics.

Before effectively implementing strategic workforce planning, an organization needs to understand what it entails, why it’s so unique, and how Enterprise Performance Management (EPM) adds value to such planning. But where to start?

What Is Strategic Workforce Planning

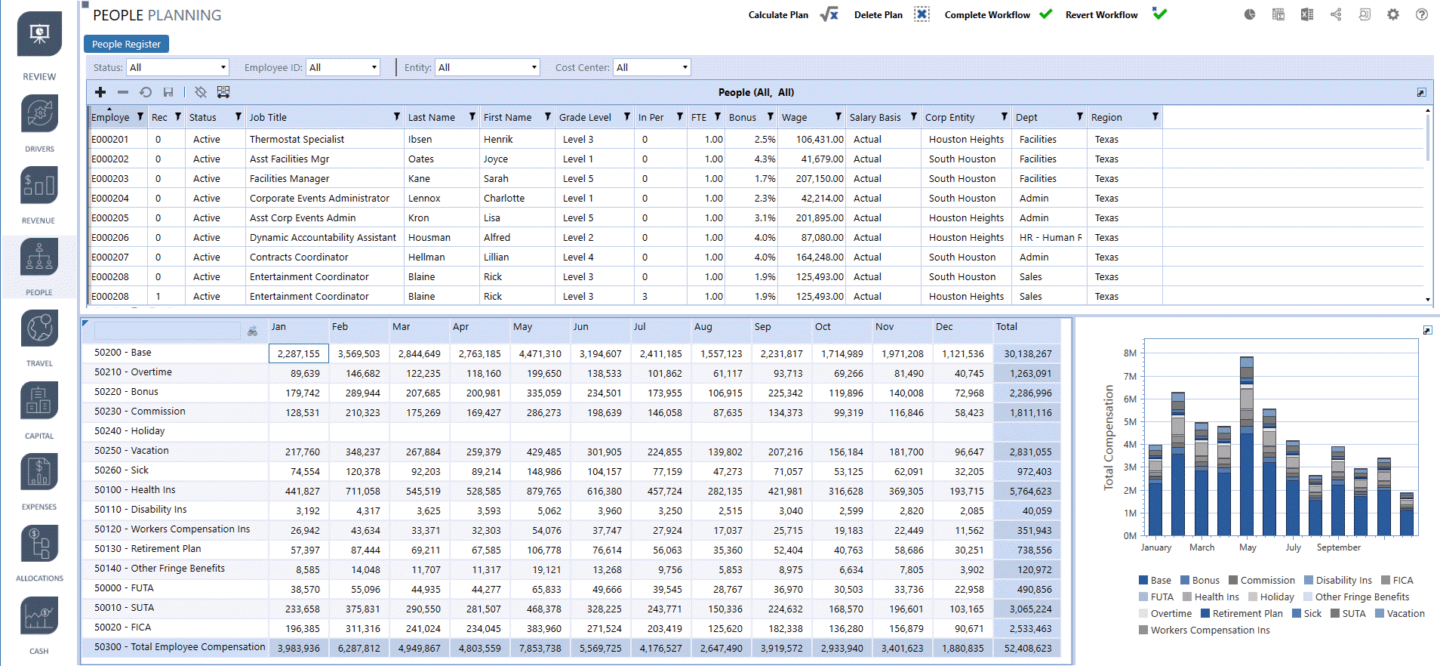

Strategic workforce planning is a long-term planning approach to hiring the right people (not just about a set of skills and expertise) at the right time (to match the business needs) and in the right place. This effort should also be fully aligned to the strategic goals of the organization. A strategic workforce planning model is pictured in Figure 1.

Why Planning for People Is So Unique

In simple terms, an organization needs to manage the following 3 factors to meet strategic objectives:

- Cash

- Assets

- People

Cash is like the “wild card” in that it grants access to people and assets.

Assets are somewhat certain. For example, an organization can classify an “office building” by a set of common characteristics within any office building (e.g., square meters, location, open spaces, power, and HVAC equipment, etc.). And that’s it — the requirements when searching for an office space somewhat match easily with the characteristics of available space.

However, people can’t be tagged in a similar way. For example, an individual may prefer higher compensation versus better work-life balance. And at a later stage in life, that same individual may prefer the opposite. Some people also value the work environment and team spirit more than others. In essence, every person is a unique individual, so planning for people requires certain solid patterns to do it right. An employer may have well-defined requirements for a job type, but each candidate will respond differently to the compensation and benefits package available.

This uniqueness makes planning and managing the workforce a difficult job for recruiters and HR departments. In addition, day-to-day operations and challenges may divert the attention of HR leaders, who could then lose sight of the strategic goals of the company. Here’s where an EPM solution for people planning can help.

Finance Teams Enables Better People Planning

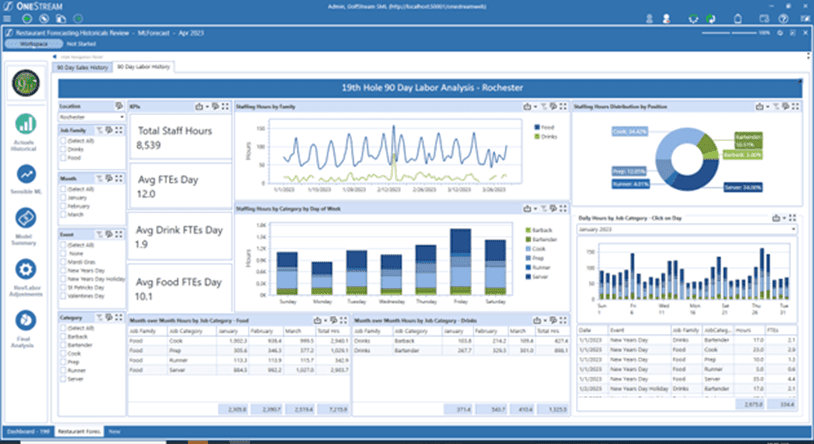

Finance teams can connect business strategy with HR planning. Why? Well, besides looking after the financial health of the company, Finance teams support leadership in shaping the strategy. They also have access to the best technology for strategic planning. Modern EPM solutions combine planning, consolidation and reporting capabilities all in a single solution. This includes a unified data model hosted in one platform that can also manage strategic workforce planning under the xP&A construct (Figure 2).

6 Ways EPM Helps With Strategic Workforce Planning

HR leaders should therefore partner with Finance teams when building the strategic workforce plan and use the same technology. Below are 6 ways a unified EPM solution can support strategic workforce planning:

- Aligns strategic planning with financial and workforce planning. All headcount and cost details live in one data model and are linked to the company’s strategic plan.

- Combines modeling capabilities. The plan is informed by modeling capabilities that use workforce data as drivers (salary, benefits, payroll, etc.) and links them with the financial model, including CapEx & cash forecasting, and along with strategic intent.

- Brings clarity in planning, budgeting and forecasting. HR leaders can generate positive impact on financial KPIs from modeling changes (new positions, promos, transfers, etc.) and perform driver-based changes (compensation, benefits by geography, etc.) in a matter of minutes.

- Facilitates agile decision-making. When the manpower budget and the total financial budget are unified, decisions are based on complete and always-available information. For example, to determine headcount needs, the fully burdened labor rates – which are composed of data from HR and disparate expense accounts – are applied to sales budgets and production capacity. When all this information is available within the same solution, leaders can plan and react quickly to unexpected events.

- Empowers HR leaders to align people plans with financial goals. HR leaders can better manage hire to retire processes and always know the financial impact. For example, overhead calculations (e.g., compensation and bonus) are automated by the system.

- Applies financial intelligence to workforce planning. The system can handle multi-currency and credit/debits automatically or perform mixed allocations (people, capital) and link them to cash flow planning, which saves analysts a ton of time.

Drawing It All Together

Today, strategic workforce planning is crucial amid uncertain market conditions. Yet strategic workforce planning shouldn’t be done alone. Why? Because it must lean on Finance teams to connect with strategy. Otherwise, organizations are left with just workforce planning, without the “strategic” piece.

An extensible EPM solution supports people planning and the financial model under the same data model– bringing significant advantages and business benefits to the table.

Bunge – a global leader in agribusiness, food and ingredients – uses the OneStream Intelligent Finance Platform to align people planning with strategy and performance. Want to hear more about how Bunge manages that alignment? Watch the webinar recording:

Demand planning is mission critical for any organization because – when done well – projects the business growth potential by anticipating the expected demand to supply. That allows for optimizing inventories and rising customer satisfaction with better service. Traditionally, demand planning sits within Sales or Supply Chain organizations, supporting the S&OP process. But since it plays a key role in the core financial processes, forward-looking Finance leaders should be finding ways to unify demand planning with Finance.

With that in mind, this blog spells out the intersections between Finance and demand planning and describes the technology available to unify demand planning with financial processes.

Understanding Demand Planning

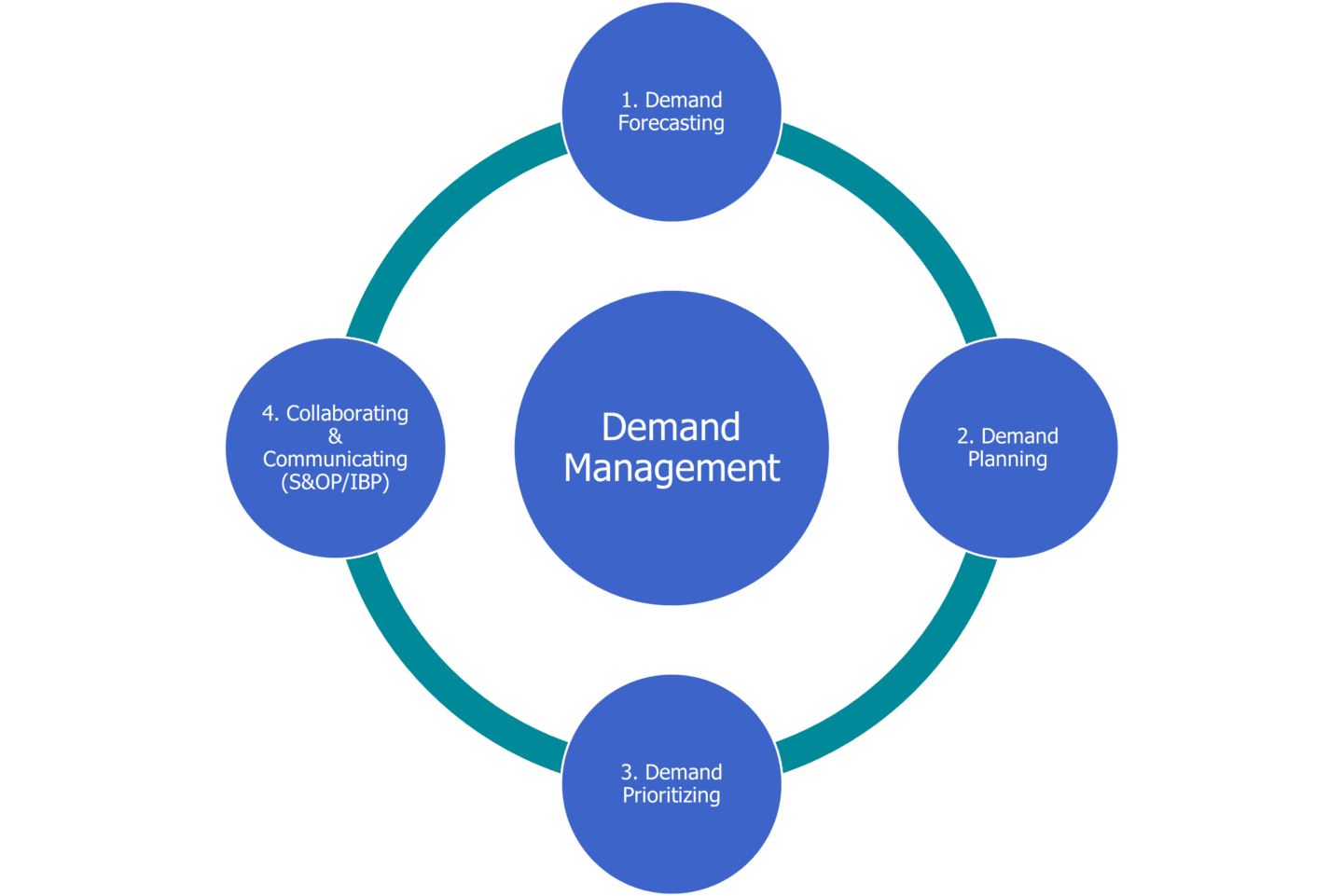

Demand planning is the first step within the demand management process (see Figure 1).

At its core, demand management represents an effort intended to match market needs with available resources. The demand management process often starts with a forecast analysis. That forecast is then enriched with inputs from Marketing, Sales, Product Development, Business Strategy and – of course – Finance to shape the demand plan. Customer orders (real demand) need to be managed and prioritized, that’s when the rubber hits the road. Finally, demand management is part of the S&OP or IBP process, an ongoing and collaborative process that ultimately helps the organization achieve better results and become more resilient.

The Value of Demand Planning for Finance

In many organizations, the relationship between the Office of Finance and demand planners is unrelated. But it shouldn’t be. Demand planners should get from Finance teams the top-down plans, financial objectives and budget figures to determine the aspiration and constraints. And – at the same time – demand forecasts can be of exceptional benefit for Finance teams.

In many ways, demand management directly or indirectly impacts the core financial processes. So why shouldn’t Finance teams benefit from using demand forecasts and plans as inputs? Those inputs can be used by Finance in many ways:

- Strategy Validation. Demand forecasts are a great way to validate strategy, especially when sales and financial objectives are too optimistic. Demand forecasts offers the Office of Finance an independent perspective built on market and business drivers.

- Financial Planning and Budgeting Accuracy. Demand plans feed marketing, sales and supply chain plans. Therefore it is a key input for planning and budgeting decisions around inventory levels, capex investments cash, spending and more.

- Profitability Analysis. Unifying the financial model with demand forecasting helps measure the P&L impact across the value chain.

- Reduced Bias. Some Finance teams feel obligated to create their own biased forecasts to meet top-down expectations and address margin and cash flow optimization pressure. Finance leaders can identify bias more easily when demand plans are incorporated into the financial planning and budgeting processes.

- Accurate Accounting. Demand plans offer a view of across a time horizon, helping controllers better predict cost, taxes and revenue allocations.

- More Credible Reporting. Finance teams can leverage the independent perspective that demand plans provide for both internal and statutory reporting. That ultimately adds credibility to financial statements.

Organizations that combine financial and demand planning can unlock the value laid out through the scenarios above (and others!). Rather than planning by siloes, organizations can take a systemic perspective to overall planning – to see the forest through the trees, so to speak.

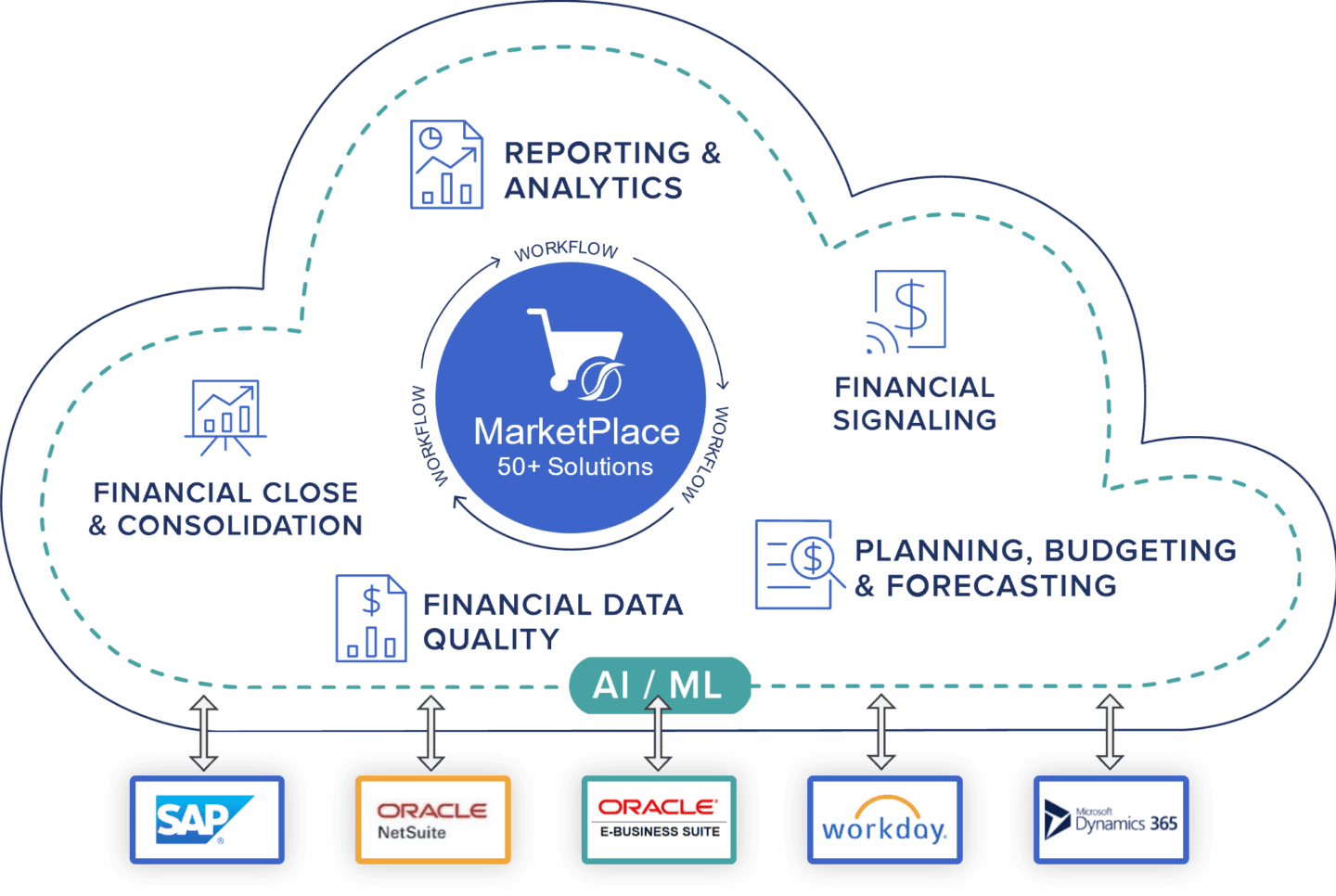

A Unified Platform for Better xP&A

Unifying demand planning with Finance is one of the many advantages an xP&A solution brings.

According to Gartner, “by 2024, 70% of new financial planning and analysis projects will become extended planning and analysis (xP&A) projects, extending their scope beyond the finance domain into other areas of enterprise planning and analysis.” [1]

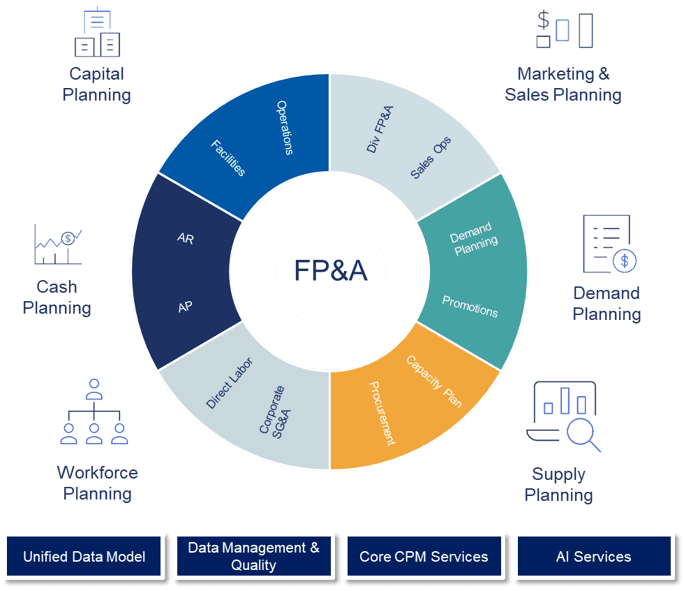

The Office of Finance can now benefit from new technologies that leverage financial and operational data with machine learning to realize the benefits outlined above. However, not every technology solution is the right fit to support a xP&A structure. Below are factors that Finance should consider when looking for a suitable technology:

- Unified Data Model. Not all solutions are technically ready to bring operational data at scale, so the solution must have a unified data model that caters to both financial and demand-related data.

- Data Management and Quality. The way the solution manages and ensures the quality and integrity in data is imperative to building one version of the truth and turning data into insights.

- Core Corporate Performance Management (CPM) Services. The solution must support the main needs of Finance teams. Having all CPM services in one platform enables strategy validation, planning and budgeting accuracy, profitability analysis, bias reduction, and more credible reporting.

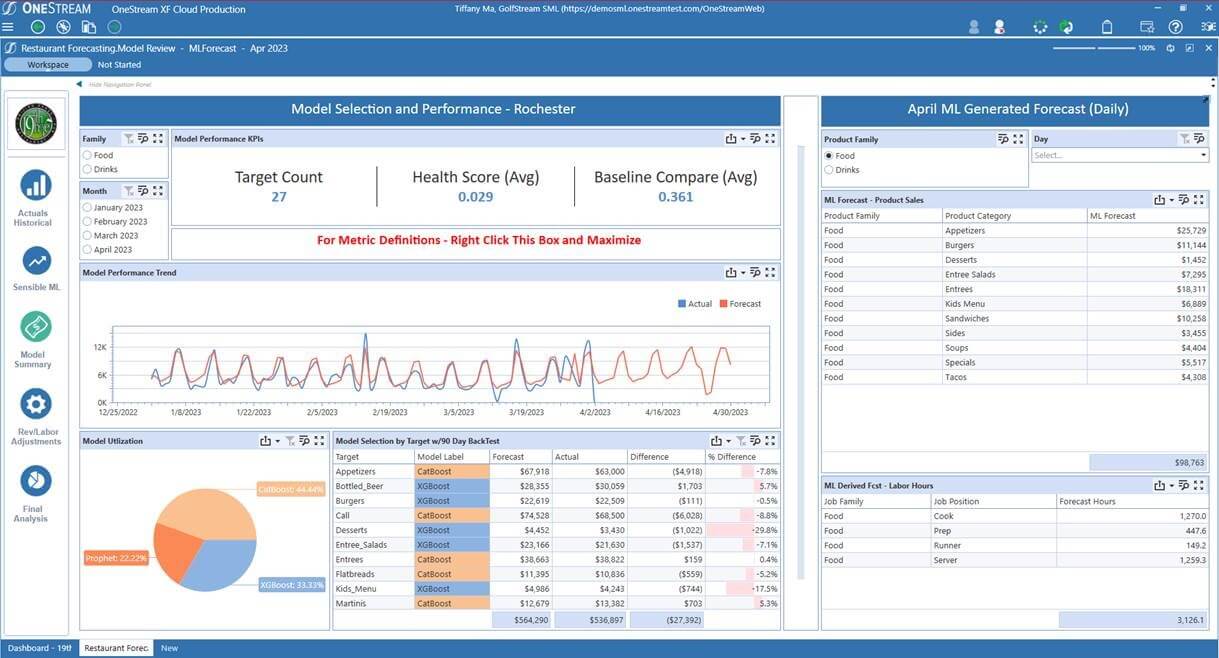

- AI Services. The solution must deliver scalable AI capabilities for the Office of Finance and beyond. Machine learning in demand forecasting is helping organizations reach higher levels of forecasting accuracy (see Figure 2).

Conclusion

Finance leaders must consider demand planning as a powerful tool for driving better results. Why? Because it provides an independent view of the market. Only a single platform with a unified data model and machine learning capabilities can deliver the xP&A requirements to unify demand planning with Finance.

A good example of what’s possible is how Autoliv – a worldwide leader in car safety system – redesigned its core processes to unify consolidation, financial and operational planning to address market uncertainty. Autoliv now leverages machine learning in demand forecasting to increase granularity, reduce forecasting cycles (daily) and bring the cost down– something otherwise not possible without the use of artificial intelligence.

Learn more about how Autoliv leverages Sensible Machine Learning to improve financial and business results:

In the previous blog post of this series, we covered why leaning on a truly single platform with an extensible data model is the most effective way to unify business strategy with planning activities across the enterprise. The prior post also laid out the framework of a unified integrated business planning (IBP) model and identified the hidden costs for organizations that implement IBP built on fragmented tools and spreadsheets.

This final post of the series shows the benefits from an IBP journey and then digs even deeper. Why? To show how an organization can maximize those benefits when the IBP implementation is underpinned by a single platform with an extensible data model.

Benefits of Unifying “Connected” Business Planning

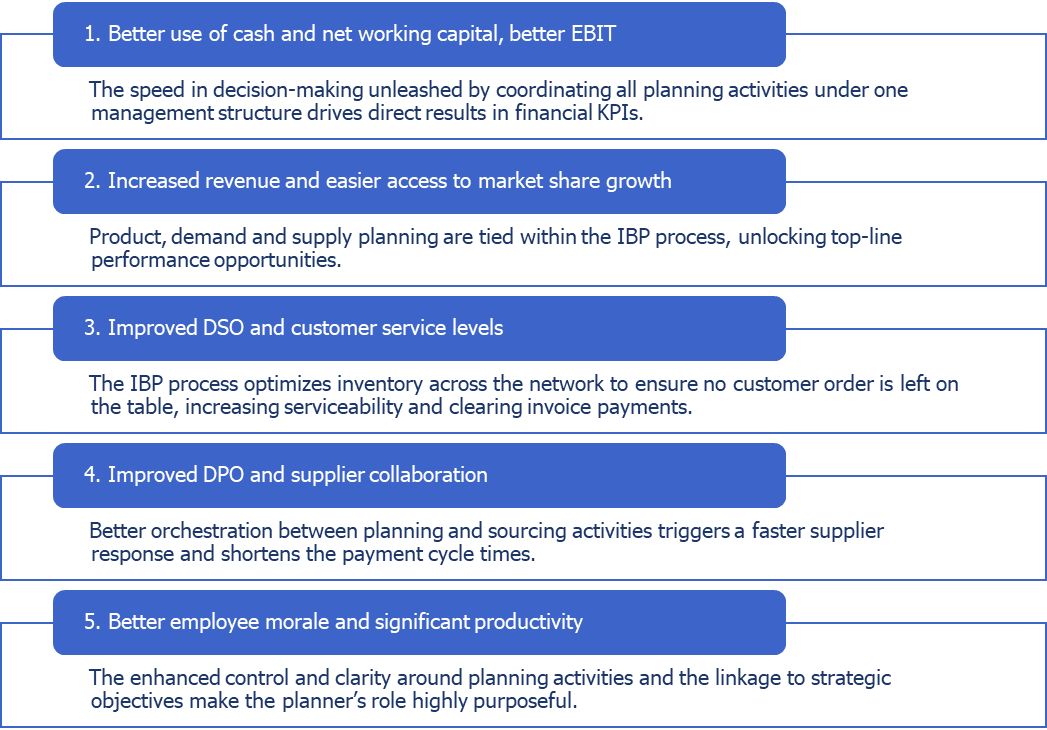

The benefits an organization can expect from an IBP implementation are diverse. In the big picture, IBP can certainly improve financial and business performance. Figure 1 outlines some of the most remarkable KPI improvements.

The range of improvement organizations claim through those benefits can be substantial, too. According to McKinsey & Company, “The average mature IBP practitioner realizes 1 or 2 additional percentage points in EBIT. Service levels are 5 to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower – and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.” McKinsey & Company also emphasizes the importance of keeping P&L owners involved in the IBP process.

Equally important to those benefits is the technology used. What’s the advantage of choosing the right technology to support the IBP process?

Simply put, the choice of technology is pivotal for achieving the highest percentile of the benefit ranges. Yet many organizations undervalue the role technology plays in achieving better results. Instead, those organizations live with sub-optimal IT architectures populated with point solutions, weak integration flows and uncontrollable spreadsheet usage. Those pitfalls only further emphasize why organizations aspiring for excellence should opt for a truly unified platform that covers the breadth of an IBP process.

Going for one platform with the right data integration model not only provides higher business benefits but also results in lower IT costs, frictionless collaboration among teams, more speed in decision-making, enhanced resilience to any changing condition (e.g., market disruptions, growth by acquisition) and less risk.

Maximizing the Value of IBP with One Platform

When one unified platform caters to the needs of integrated business planning, organizations can aspire to get the highest return of value from the IBP process. Having one platform that unifies business strategy with all planning activities, consolidation and reporting provides unmatched levels of performance. And this advantage is exactly what organizations get when choosing to support their IBP journey with OneStream’s Intelligent Finance Platform (see Figure 2).

OneStream’s Value Realization Report validates the platform advantage. The report details the benefits that adopters of OneStream’s Intelligent Finance Platform achieve across the different domains that pertain to corporate performance management: data management, close & consolidation, account reconciliations, reporting, and planning & budgeting. According to the report, OneStream simultaneously generated value in four different areas:

- Technical Debt (i.e.,difference between current state cost and future state costs.) One platform drastically reduces or eliminates certain technical costs. Those costs include administrator costs, hardware and data center costs, upgrade costs, data warehousing, third-party software to complement or enhance the applications (e.g., machine learning engines, inter-company eliminators, currency converters, etc.), disaster recovery costs and more.

- Effectiveness. Being more effective or making better decisions faster is possible by simply having information readily available at the right time and with the right level of detail. The use of one platform and one data model increases effectiveness significantly. Why? The need for continually copying, moving and reconciling data among different point solutions is eliminated.

- Risk Mitigation. OneStream helps avoid costly mistakes caused by manual step errors and the lack of traceability and auditability. The full advantage comes by having full, direct integration with systems such as GL/ERP and other source systems.

- Efficiency. According to OneStream’s Value Realization Report, “Planning and Budgeting takes less time for OneStream customers. A customer that moved from a rudimentary Excel®based system to their first budgeting tool saw a revolutionary improvement of 95%. Customers who moved from another budgeting tool that was relatively sophisticated saw between a 10% and 25% improvement in the time they spent on budgeting after implementing OneStream.” On average, OneStream users see efficiency improvements of 42%.

Data management is massively improved as well. According to the report, “Customers improved their data management processes, delivering results between 98% improvement when moving from a complex system with several disparate systems and 10% when upgrading from a system that is already fully integrated but needs to take advantage of more fluid flow of data and information.” This improved efficiency ties directly back to the financial and business performance KPIs introduced earlier in this blog post (see Figure 1) – i.e., significant productivity gains, better use of cash, net working capital, better EBIT, revenue and market growth, better service levels and improved DSO, DPO and DIO.

Conclusion

This blog series highlights why current market conditions require new approaches to integrated business planning and why many organizations struggle to implement IBP due to three main challenges: lack of leadership support, organizational resistance and underestimating the technology needs.

These challenges aren’t insurmountable, however, thanks to advanced technology solutions that truly unify business strategy with planning. And when organizations aspire only to excellence, one platform with a single extensible data model is the key to successful IBP implementations.

OneStream’s Intelligent Finance Platform delivers in that regard. Its data-first approach to integrated business planning unifies the views of strategy, planning and performance – increasing the speed of decision-making and improving business performance.

Learn More

Discover OneStream’s Intelligent Finance Platform advantage here, and download the Value Realization Report

Download the Value Realization Report

As stated in our previous blog post titled “Why Is Integrated Business Planning So Hard?,” we examine why unifying integrated business planning (IBP) or connected planning processes enables organizations to ensure they take a data-first approach to all planning activities. Such a planning approach aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one version of the truth within a single, seamless technology platform and user experience.

A trusted, common view of the numbers provides a robust baseline for agile decision-making and keeps all teams together, collectively trying to achieve the same corporate objectives while staying focused on specific KPIs. In other words, the different teams maintain their independence while working in unison to achieve corporate success by leveraging the same trusted and governed data.

This approach is underpinned on a single technology platform that can manage planning, budgeting & forecasting (PB&F), consolidation and reporting all in one place – without the need to duplicate data or otherwise maintain different solutions. The advantages of this approach are many:

- Trust in the numbers. While every function plans at a different level of granularity, all can be tied back to financial metrics and strategic objectives because all functions are using the same data within the same platform.

- Leadership buy-in. Using one version of the numbers is pivotal to managing business performance. No substitute exists for a single accurate picture of plans and performance, so hardly any CEO and CFO would turn away from this advantage.

- Improved collaboration. One key aim of unifying business planning is to help reach consensus among all planning parties. When teams no longer need to collate and compare plans, collaboration flows and allows consensus planning to happen faster.

- Instant response to events. When the same data is used for forecasting and consolidation, actuals can be served to support shorter forecasting cycles (daily, hourly) and what-if simulations. In current volatile times, this capability offers a true competitive advantage.

- Faster IBP process implementation. If one of the IBP fundamentals is “one set of numbers,” why not set it as the single most important requirement for any IBP process implementation? Having one single technology and data model is a unique way to obtain “one set of numbers.” When this requirement is met first, the IBP process can deliver faster business integration, establish a superior planning structure and begin to model the right culture and behaviors.

Leading the Change

Intelligent Finance teams lead business planning unification and foster collaboration across the organization. While the teams oversee and facilitate the planning activity, doing so should not suppress the detailed planning required between and by the different business lines and functions (e.g. Supply Chain, HR, IT).

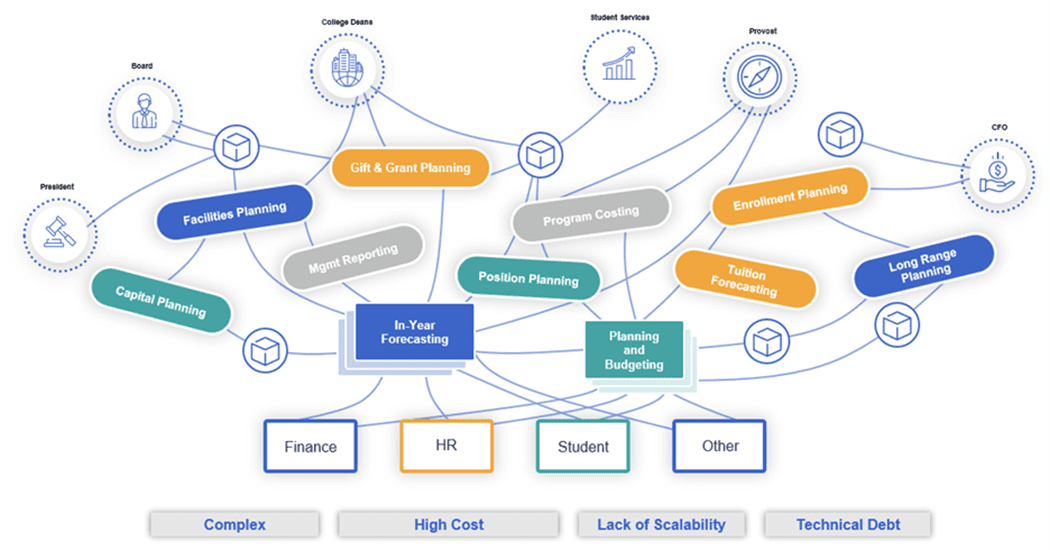

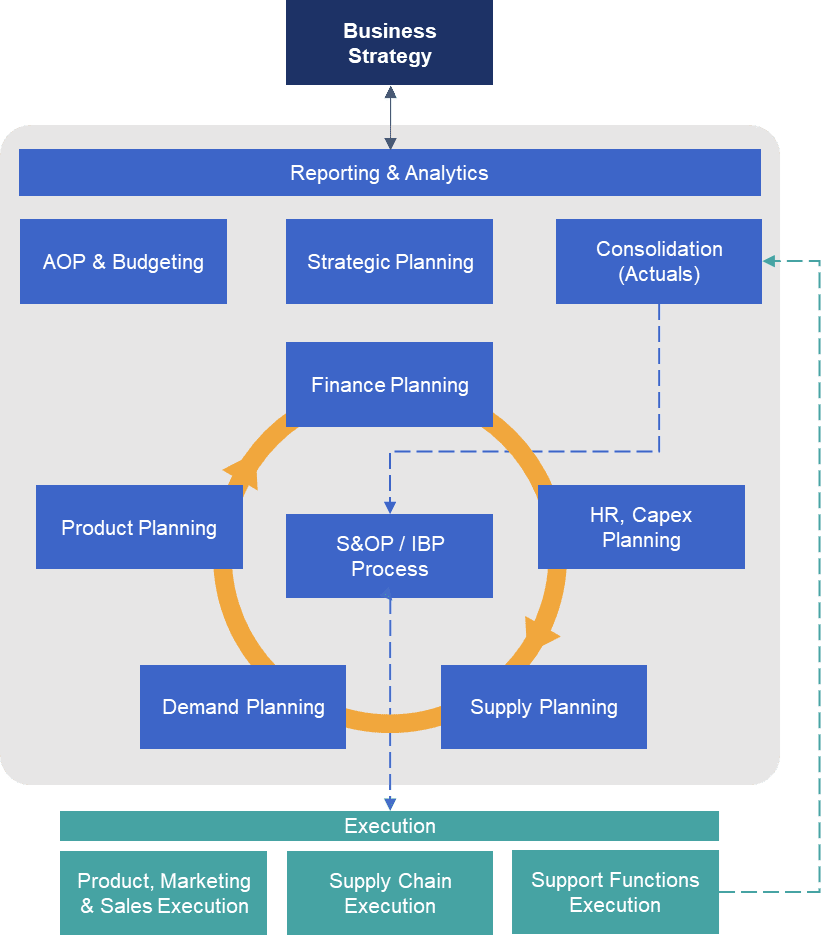

Instead, all planning activities should focus on a central Finance planning capability that orchestrates and aligns data, strategy, processes and people across the different business units and functions (see Figure 1). This central capability is simple to understand when the main mechanisms to show market value and performance against strategy goals are financial artifacts such as P&L, balance sheet, and income and cash statement.

Unfortunately, most options for connected planning, integrated business planning are simply not built for this purpose. Why? Rather than relying on a truly unified data model, Finance and IT teams are forced to connect plans across systems and spreadsheets by moving and reconciling data. Those processes, in turn, add material risk and cost to integrated business planning efforts.

In other words, true unification matters – a lot.

How to Unify Business Planning

Unified business planning is anchored on 3 key principles:

- Principle of collaboration. Team collaboration starts with adopting a clearly communicated vision, setting the expectations around teamwork, and defining KPIs aligned to strategic objectives and financial attainment. Finance should orchestrate and foster collaboration and support all teams. Ideally, a leadership role – one that reports to the CFO – should be established to orchestrate all planning activities.

- Principle of simplification. Simplification occurs as a result of process step elimination, minimization and automation. Planning processes should be challenged by removing complexity, redefining measurements and ultimately automating tasks. When a unique view of the plan is instilled, the need for file version control, data reconciliation and validation is drastically reduced or eliminated.

- Principle of technical unification. This principle is the single most important precept to follow in a unified business planning approach. Achieving technical unification calls for breaking away from suboptimal technology solutions and spreadsheet patching. Instead, such unification requires considering a solution capable of managing both financial and operational forecasting, planning and budgeting processes while providing financial consolidation, reporting and analytical tools all in one place – and doing it with speed and scale (see Figure 2). When a single solution is used to manage all these processes, bringing people together and simplifying the process becomes easier.

These principles not only provide a robust foundation throughout the IBP journey, but also facilitate the adoption of technology that truly unifies people and processes.

Unified Integrated Business Planning Model

A data-first approach to integrated business planning unifies the views of strategy, planning and performance, increasing the speed of decision-making.

Figure 3 shows the model for unified business planning platform. In light gray, the figure shows the key processes that must be part of the same platform under one data model to reap the benefits of this approach. The figure also displays a representation of an IBP process with a closed loop between planning and execution – a loop that remains aligned to the business strategy because everything relies on the same data and technology.

Unify Integrated Business Planning, or Face the Hidden Costs

Unifying integrated business planning brings data and people together, helps the organization model the right behaviors, and removes the friction of traditional technology silos and spreadsheets.

Today, Finance leaders have the organizational influence to lead an IBP process based on a unified approach. However, unifying integrated business planning requires one single platform and extensible data model, not an integrated set of connected modules from the same vendor. This approach offers the most effective way to unify business strategy, planning and performance.

By not taking a unified and data-first approach to IBP process implementation, organizations face the hidden costs of dealing with archaic and fragmented technology:

- Technical debt: Cost of maintaining outdated or obsolete technologies.

- Reduced efficiency: Costly mistakes derived from reconciliation and manual touch-points.

- Less effectiveness: Organizational friction and higher elapsed time between planning and execution.

- Higher risk, opportunity loss: Result of slow, biased decision-making.

Learn More

Learn how to maximize the benefits of Integrated Business Planning in our next blog:

Planning for business is becoming increasingly more complex, requiring new approaches supported by sophisticated planning technologies. Recent research even indicates that business strategy, financial and other planning activities (operational, HR, sales, etc.) are better together. Thus, Connected or Integrated Business Planning (IBP) has become a hot topic for leaders who want to thrive in this challenging business context. But why is IBP so hard to implement?

This blog series looks to answer that question by diving into why companies aren’t successful when adopting Integrated Business Planning. In doing so, the series explores why the CFO is best positioned to lead the change. Part 1 explores why Integrated Business Planning is difficult.

A Broken Mirror

Connecting or integrating business planning activities across the enterprise is not a new idea. In fact, concepts like xP&A aim to respond to this need from a technology perspective, and terms like Integrated Business Planning have been around for decades. However, today’s unique market volatility combined with failed attempts at connected planning shows why the topic needs to be elevated to the C-level.

Organizations encounter various obstacles when implementing an Integrated Business Planning process. And those organizations invest significant resources and time trying to overcome challenges and get the process to work. Amid a long list of challenges, 3 stand out as the most difficult to overcome:

- Leadership skepticism and misalignment around the IBP process. As Oliver Wight rightfully points out, “one set of numbers” is a stepping stone in a well-deployed IBP process. However, getting there isn’t easy. But why? First, the current state of technology and data strategy in many organizations doesn’t support an IBP process. Second, some might be uncomfortable with this better reality: the visibility that comes with one view of the numbers can surface human bias, shortcomings or resource buffers that some leaders want to keep hidden.

- Culture and organizational change can’t do it alone. Companies structured in silos fail to connect strategic goals with planning, model the wrong behaviors (conflicting targets, biased assumptions, etc.) and force a fragmented planning approach. How does all this affect the IBP process implementation? Well, adjusting the culture and behaviors is hard work, as well as setting up a solid management system and implementing horizontal roles to coordinate planning activities across silos. This process requires an enormous effort in culture change, and it doesn’t stick in the long term: organization and culture tend to mold and deform over time in response to leadership changes or strategic direction shifts. Further, today’s volatile business environment requires unparalleled speed in decision-making that can’t be held up by sluggish changes in governance and organizational design.

- Ignoring the technology trap. Having one technology for all planning is a complex endeavor. Finance planning, business unit planning, sales & operations planning, workforce planning (to name a few) are all processes with different goals, data structures, units of measure, mathematical foundations and needs. Even if functional technology is in place to handle these different planning needs, scalability becomes an issue when the solutions are exposed to massive amounts of data.

So…what are the options? Well, many of the solutions out there cannot adapt to current needs due to being made of multiple modules that must be integrated or simply not having the depth and breadth required to support varied planning needs. The alternative, then, is spreadsheet abuse that’s slow, laborious and prone to error. And those organizations that manage to integrate all these modules from different software vendors do it at a high cost and effort, living up with an infrastructure that doesn’t scale and a tremendous technical debt. In other words, the alternative is high RISK and high COST.

Since culture change is never easy and most technology can’t address the needs of truly unified planning, leaders are discouraged from embarking on an IBP journey and stall with sub-optimal processes and technologies.

This sub-optimal status often means a higher impact from risks and uncertainty due to a sluggish decision-making process. Ultimately, that impact translates into the loss of business opportunities and a higher cost of doing business.

A Closer Look at the Technology Trap

Even with strong alignment and commitment around the IBP process, a closer look into the problem shows that organizations struggle to achieve the promised benefits for a specific reason. Primarily, a consensus among planning activities that effectively links strategic & finance goals with financial and extended planning (xP&A) is complicated when technology isn’t fit for the task.

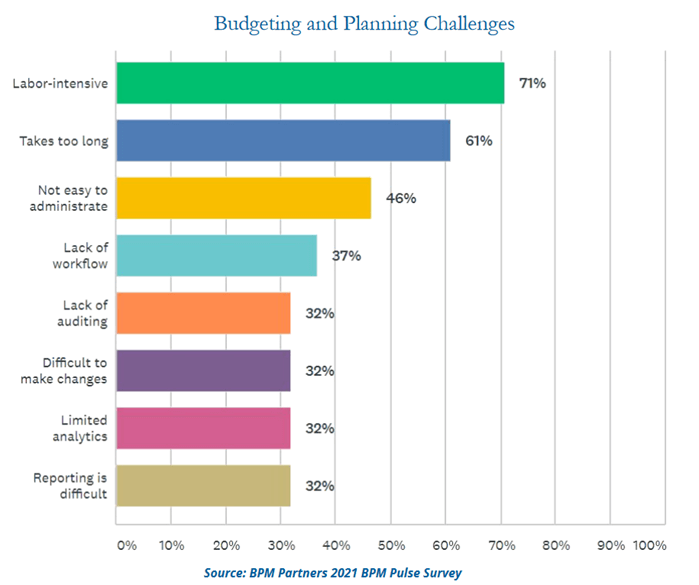

The Pulse Survey launched by BPM Partners in 2021 (Figure 1) displays some of the main challenges an organization can face with budgeting and planning activities:

Collectively, such challenges are strongly correlated to the flawed technology solutions that organizations use to support these processes.

Often, many organizations undertake the implementation of IBP from a process and organizational standpoint, leaving the technology discussion for later.

However, if one set of numbers is a non-negotiable in IBP, why not address the technology trap for starters? Wouldn’t collaboration be easier with a common foundation of data and information? Wouldn’t it be easier for top leadership to execute flawlessly when all planning is based on the same numbers? Why wait for a perfectly fine-tuned process when the right technology can accelerate the adoption of IBP?

There’s Another Way

When business planning isn’t unified, the leadership team can’t really get quality insights fast enough to improve the business performance. Because planning is a cornerstone to budgeting and forecasting processes, both are impacted when the planning processes are carried out in a containerized way supported by inferior technology. The different departments and functions suffer the consequences of a fragmented planning approach.

Despite the many attempts to join and synchronize all planning activities, these planning processes remain disconnected because they rely on different technologies and systems that cannot provide a common data structure.

But a (better) way forward exists, one where the CFO leads the change by implementing a collaborative planning approach with business lines and other functions. Whether that occurs through xP&A, integrated business planning or connected planning, ultimately what CFOs really need to do is unify business planning.

By unifying IBP or connected planning processes, organizations ensure they take a data-first approach to all planning activities. Such planning approach aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one single version of the truth. That single version is verifiable and certified in just one technology platform.

Learn More

Learn how to unify Integrated Business Planning in our next blog: