This article was originally published on CFO.com

Finance chiefs are under pressure to leverage more sophisticated technologies to professionalize and modernize their operations. They also face increased scrutiny around the accuracy and timeliness of their data. Corporate performance management (CPM) tools, in particular, can play a critical role in these situations but are often poorly understood.

Myths and misinformation about CPM technologies and their use in finance departments abound. However, the bottom line is that CPM is an essential component of any broader strategy to enable finance digitally. Therefore, CFOs need to know how CPM can help meet and execute value-creation plans and be leveraged for minimum cost and maximum return on investment.

Beyond being misunderstood, CPM terminology can also be unclear. CPM solutions represent a suite of technology tools, specifically those that focus on the digital enablement of finance (including financial close and consolidation, budgeting, forecasting, strategic modeling, and financial reporting functions). CPM software complements enterprise resourcing planning (ERP) solutions and analytical reporting environments (data warehousing, data lakes, and data marts).

While some CFOs are ahead of the curve in using CPM tools, most are not. They often see spreadsheets as the quickest and fastest way to stand up some level of CPM-related competencies. Unfortunately, that approach is usually not very successful.

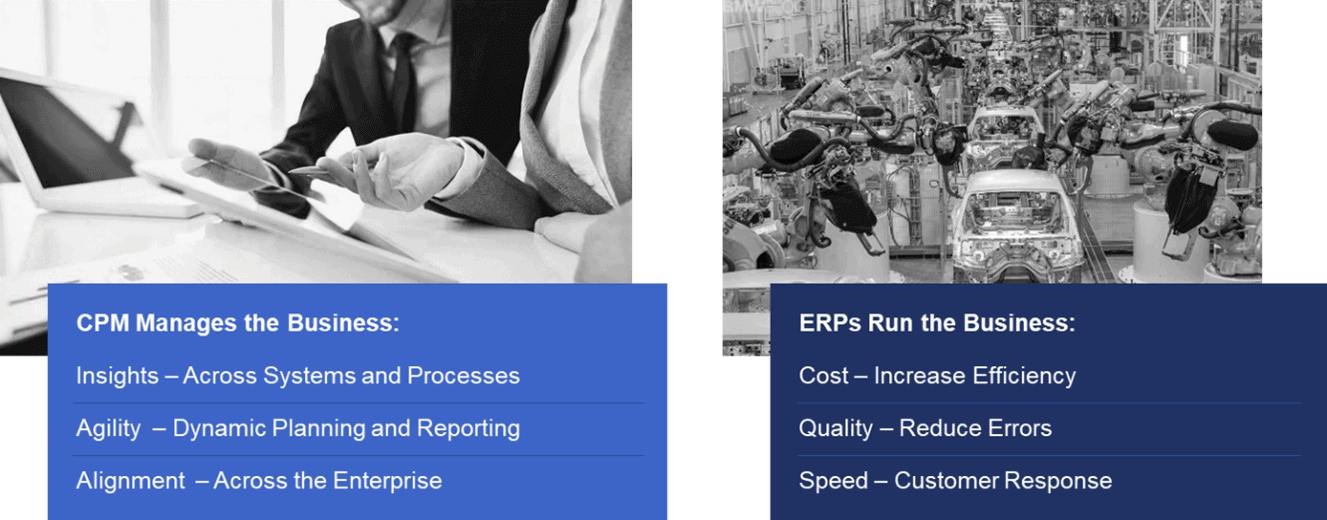

Comparing CPM Software to ERP Systems

To understand CPM solution capabilities, understanding their context is crucial. For example, how does CPM software complement ERP systems? When and where do the systems interact? Can an ERP system be used in place of a CPM solution?

Sophisticated CFOs understand where an ERP system sits within an organization’s overall financial stack: it supports finance’s back-end operations (order-to-cash, procure-to-pay, record-to-report, for example). Equally, these CFOs understand the need for accurate and timely information delivered through a data warehouse, data mart, or data lake.

A CFO’s experience with ERPs and analytical solutions (combined with unfamiliarity with CPM tools) often leads to “shoehorning” close/consolidation and budgeting/forecasting capabilities into the ERP system or data warehouse. That setup is then augmented with large, complex spreadsheet workbooks.

Naturally, there is an inclination to leverage existing technology (ERP, data warehouses, spreadsheets) to address CPM-centric financial functions. After all, CFOs want to make every portion of their tech spend count.

But leveraging technology to support functions for which they were not intended often leads to complex architectures, data integration challenges, diminished functional capabilities, effort-laden processes, and error-prone solutions.

The Automotive Analogy

An automotive analogy can be helpful to simplify and articulate the interactivity and criticality of multiple systems.

The ERP system is the engine in the car; it makes everything run. The data analytics and reporting platform is the dashboard. The operations of the vehicle are faster and more efficient with an informative dashboard. The dashboard tells the driver point-in-time information (how fast the car is going, the amount of fuel in the tank, whether the tires need air).

A CPM solution is like the GPS; It helps navigate the car. It understands where the driver is going and helps them get there efficiently while re-routing for unforeseen obstacles.

CPM systems model multiple scenarios, allowing CFOs to understand various financial impacts and to incorporate an operational context (weaving in operating data side-by-side with financial data). This information is critical in a volatile economy but impossible to attain with ERP and analytical tools alone. The CPM system is purpose-built to support these functions.

Understanding the Relevance

CPM systems originated and matured in large organizations. However, there are many reasons that CFOs of midsize and private-equity-owned companies should consider adopting them. These include the following:

Price. The advent of the cloud has driven down the price point for many subscription-based solutions, including CPM. As a result, mid-market companies can now take advantage of tools historically available only to enterprises, while realizing meaningful ROI from their implementation.

Complex Architectures. Some PE-owned companies have more complex architectures than even the largest publicly held companies since they usually create value through roll-ups, carve-outs, and other kinds of acquisitions. These structures result in complex technical architectures, multiple general ledgers, various back-end operational systems, and numerous financial systems. The CFO is charged with instituting and standardizing the controls and processes required to support internal and external financial reporting and projections.

Rapid Rate of Change. Given the focus on value creation, the rate of change within a PE portfolio company or an acquisitive midsize company can far exceed that of larger organizations. PE-backed companies are in acquisition mode, bringing in new charts of accounts, new organizational alignments, new product lines, and new sales channels. Finance must also act on deal origination and integration within a more accelerated timeframe to meet the demands of the financial sponsor.

Balancing Operational Autonomy with Controls. All kinds of organizations need technology systems that empower them to act with autonomy in a non-disruptive capacity while simultaneously giving the CFO the stewardship and control the office of finance requires to execute its job.

Lean Teams and Limited Resources. Many companies have limited resources. CPM solutions address limitations by minimizing manual data collection, organization, and consolidation processes and maximizing higher value-add functions such as modeling projections and analyzing results to inform decision-making.

Learn More

Even when a CFO understands the importance of CPM to an organization, they may be hesitant to invest in the technology. The second part of this column, to be published later on this blog, will address CPM myths. To learn more about CPM solutions visit www.onestream.com.

Get Started With a Personal Demo