State & Local Agency Budgets: Planning and Forecasting Challenges

For state & local agency budgets, planning and forecasting are critical functions that ensure the efficient use of taxpayer funds.

But despite having made significant investments in Enterprise Resource Planning (ERP) technology, many agencies still find significant challenges in navigating the extremely complex process of government budgeting. Why? Because ERP systems were not designed to manage the complexities of government budgets. Unfortunately, many entities strive to build around these limitations with patchwork systems of point solutions of financial forecasting software and spreadsheets. This patchwork approach only leads to further challenges where agency financial teams must contend with bottlenecks, disparate data sources and siloed planning processes. So how can state and local agencies rise above these challenges?

In Smarter, Faster, Better Budgets: How to Supercharge Your ERP to Make Better Use of Financial Data – a recent webinar hosted by Governing, a division of e.Republic – panelists discussed the answer to that question.

Governing provides news, analysis and insights for the professionals leading America’s states and localities. Published since 1987, Governing is a trusted source of record for elected, appointed and other public leaders looking to manage the present and anticipate the future of state and local government.

In the webinar, moderator Justin Marlowe, Senior Fellow, Center for Digital Government, discusses with panelists Brenda Decker, Senior Fellow, Center for Digital Government, and Joel Bittick, Regional Manager – SLED, OneStream Software, the complexities and unique challenges of government agency budgets. In addition, panelists discuss how modern financial forecasting software addresses these challenges by seamlessly integrating with ERP systems and unifying financial management functions.

Conquer Complexity in Budgeting with a Unified Finance Platform

Mr. Marlowe begins the discussion with a question on why so many state and local governments maintain standalone processes for key parts of financial processes despite significant investment in ERP technology. Then, Mr. Bittick describes how most state and local agencies have made significant investments in ERPs to get actual results right but have realized a gap in what ERPs can deliver.

This gap leads to those agencies relying on Microsoft Excel® or point solutions for many functions, such as fund/account reconciliations, grant planning, operational planning and Annual Comprehensive Financial Report (ACFR)/Popular Annual Financial Report (PAFR) statutory reporting. As Mr. Bittick explains, these standalone tools, especially spreadsheets, are prone to errors, lack controls and audit trails, and have limited scalability.

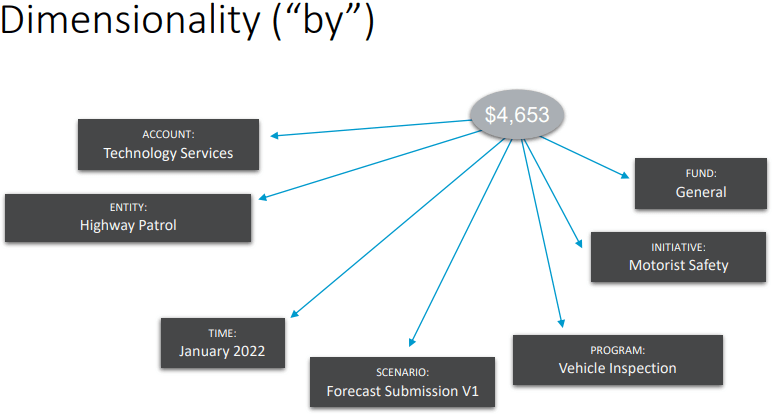

Mr. Bittick then explores how spreadsheets cannot effectively address the data dimensionality needs of state and local agency Finance teams (see Figure 1).

After that discussion, Mr. Marlowe addresses Ms. Decker with a question on how to respond when someone says their spreadsheet is too complex to integrate in a financial system. Ms. Decker, drawing on her experience as the Chief Information Officer of the State of Nebraska for 10+ years, describes how most ERP systems were not designed for government agencies. As a result, users often needed to rely on spreadsheets that could be built to users’ specific needs. She explains the answer to this issue is to invest in a financial platform that can be layered atop ERP systems and meet the unique needs of government agencies.

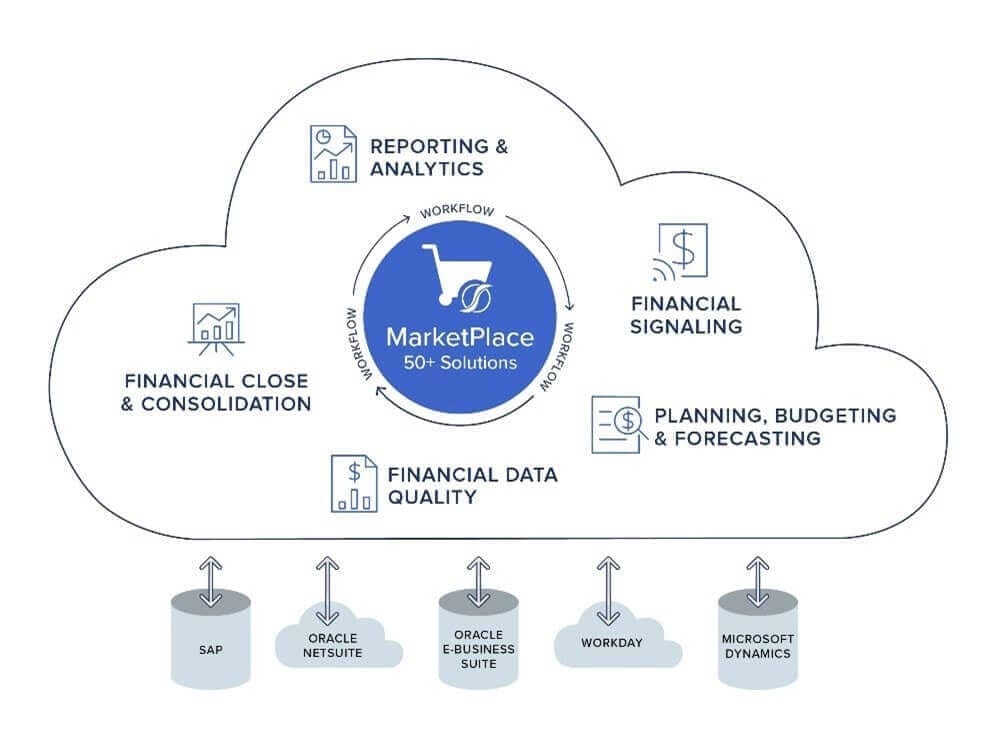

Next, in a specific question to Mr. Bittick, Mr. Marlowe asks how an agency would use OneStream’s Intelligent Finance Platform to modify the static chart of accounts in an ERP system to be more appropriate for that agency’s reporting or budgeting. Mr. Bittick describes how OneStream is a complementary layer to ERP systems, which primarily manage financial transactions. Further, he emphasizes, OneStream seamlessly integrates with ERP systems to enable financial analysis, budgeting, planning, forecasting, close and reporting.

He describes how OneStream does not replace ERP systems but instead complements and aligns with them (see Figure 2). Elaborating, he discusses how OneStream empowers agencies to manage performance by combining efficient and transparent actual financials with forward-looking plans to measure outcomes and performance. Ms. Decker adds to this discussion by explaining that ERP systems lack the planning capability to measure the value to fulfill agency obligations to citizens and efficiently manage their money.

Mr. Marlowe then begins a discussion on the challenges of managing federal funding to states and local agencies, such as funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Inflation Reduction Act. Focusing on some of the challenges with these funds, he discusses having to manage the variations in tracking and reporting requirements, among other related aspects.

Ms. Decker replies to note “that money comes with a lot of strings.” Elaborating, she focuses on the variations in compliance and reporting of grant funding, including the difficulties in managing pass-through grants. Those grants, she emphasizes, require the agency to not only report on how it dispersed the funds, but also track and report on how the recipients used those funds. She further explains that, to remain compliant with grant requirements, government agencies must often track things that are not normally tracked in ERP systems.

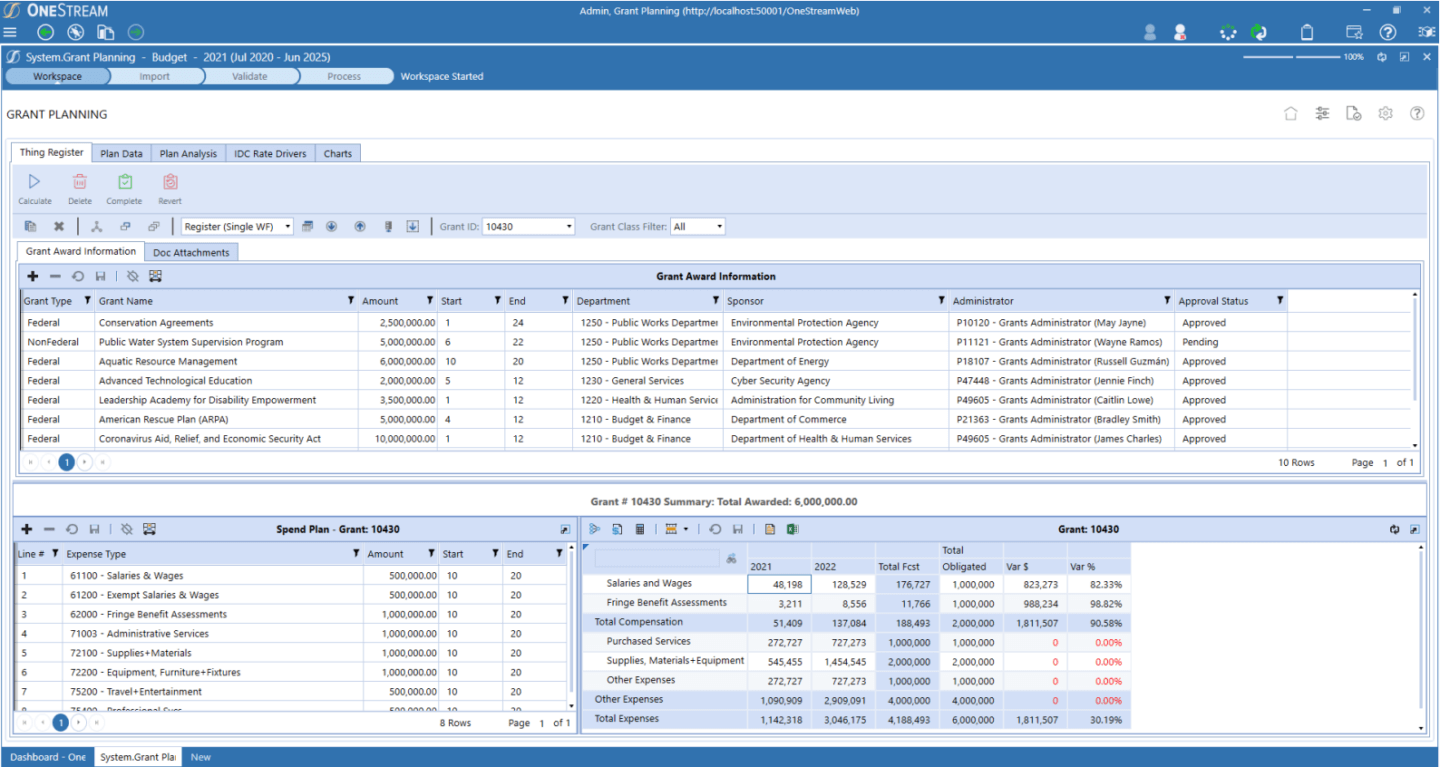

Following that part of the discussion, Mr. Bittick explains how OneStream’s Intelligent Finance Platform unifies Finance processes, including solutions such as Grant Planning (see Figure 3). He further explains how this solution enables government agencies to track all their grants and grant information within the platform regardless of the number of grants. This grant tracking includes all spending split by salaries and wages, purchases, services and other expenses. Emphasizing the benefits of the tracking, he notes how the solution incorporates both tracking and planning with full auditability. Ms. Decker also jumps in to emphasize the importance of this planning capability as agencies must carefully evaluate the long-term impact of grants, especially when the initial grant funding will create a future funding obligation after the grant funds are used.

Continuing the theme of forward-thinking, Mr. Marlowe asks the panelists about the challenges government agencies face in reporting on return on investment and specifically with performance-based budgeting.

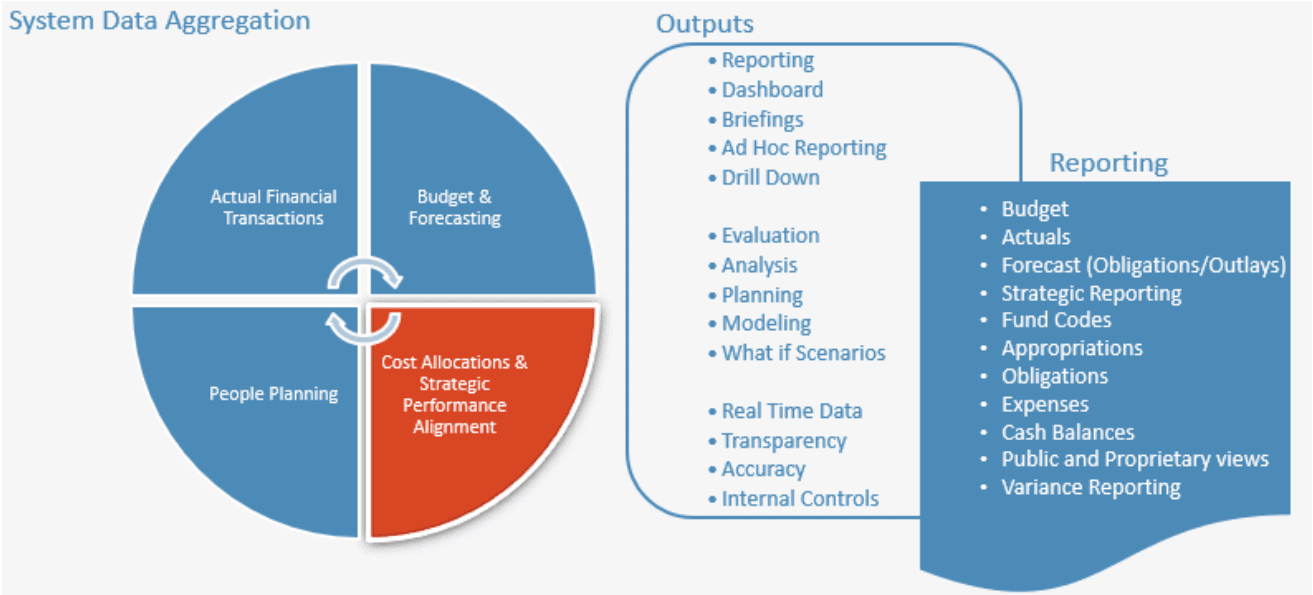

Ms. Decker describes how establishing ROI metrics can be very difficult for government agencies, who often must fulfill mandates that are challenging to measure. As an example, she contrasts the clarity of measuring the completeness of a road construction project with an ease-of-access project. In the latter, the results are relatively hard to define, so agencies should look for systems that can accommodate this need. Mr. Bittick then provides an example of how a current OneStream customer is leveraging the platform to implement performance-based budgeting (see Figure 4). Specifically, he describes how the customer engages OneStream to define ROI metrics.

As the webinar draws toward a close, the panelists conclude with a discussion of how current inflation rates are impacting state and local agencies’ budgeting processes. Ms. Decker describes how agencies are being asked to plan for multiple scenarios in response to inflationary pressure and how ERP systems don’t have the capability for multi-scenario planning. Continuing the discussion, Mr. Bittick explains how a large state agency that has been struggling with spreadsheets is leveraging OneStream to respond to changing inflation rates by recasting forecasts monthly with the previous month’s actuals included. This process would be extremely difficult with spreadsheets, but it takes only a few minutes with OneStream’s financial forecasting software.

Conclusion

When seeking to improve the efficiency and effectiveness of budget processes to optimize the use of taxpayer funds, the Finance teams of state and local agencies are faced with different complications from their business counterparts. ERP systems are effective in managing agency financial transactions, but the systems aren’t designed for the unique requirements of government planning. And as the webinar highlights, OneStream’s Intelligent Finance Platform complements and aligns with ERP systems and enables agencies to conquer complexity in government budgeting, planning and forecasting.

Learn More

Want to learn more about OneStream’s state & local agency budget, planning and forecasting capabilities for Finance teams? Watch the webinar replay here, or contact us for a demonstration.

Get Started With a Personal Demo