With the evolution of cloud computing and the emergence of many new technologies that can increase productivity, Finance systems have been evolving in recent years, bringing new benefits to enterprises that adopt them. However, many organizations remain mired in legacy systems and aren’t fully aware of what new solutions are available in the market and the benefits that can be achieved from modernizing Finance systems.

Documenting these trends is the focus of the 2019 FSN Future of Finance Systems Global Survey. Based on responses from 532 senior Finance professionals around the globe, across 23 different industries, the survey found that the current state of Finance systems in use by many organizations are unable to support the dynamic environment in which businesses operate. The report concluded that Finance systems are failing CFOs in their role as strategist and business partner and are leaving organizations vulnerable by failing to enable businesses to respond quickly to market changes.

Read on to learn what the report revealed about what’s holding organizations back from modernizing Finance systems, what their expectations are for future Finance systems, and best practices in driving change.

Current State of Finance Systems

As a key component of Finance transformation, a company’s Finance systems should be supporting the emerging role of the CFO as strategist and business partner. The systems should be adaptable and agile enough to enable the business to respond speedily to market changes. This is crucial in the face of the  digital disruption that is occurring across industries, with technology enabling new business models as well as new competitors that can deliver faster, better services. But unfortunately, Finance systems that add value and strategic insight are not the norm.

digital disruption that is occurring across industries, with technology enabling new business models as well as new competitors that can deliver faster, better services. But unfortunately, Finance systems that add value and strategic insight are not the norm.

According to the FSN survey, the basics are there, with three quarters of respondents saying their Finance systems support the traditional role of financial stewardship, regulatory compliance and control. But only half say their systems provide the information needed for CFOs to play an active role as board advisor and strategist. This is the bare minimum any Finance system should be providing, and only 53% can do that. In addition, the survey found the following:

- 42% have Finance systems that enable CFOs and Finance executives to be effective business partners

- 31% say their Finance systems provide a quick and dependable platform for decision-making

- 29% Say our Finance systems allow us to accurately predict performance

- 23% Say our Finance systems allow us to respond speedily to market changes

The limitations of their Finance systems mean companies are at a disadvantage in a competitive marketplace, and it could have a significant impact on their prospects for the future. So what’s holding them back from modernizing Finance systems?

According to the FSN survey, half of organizations can’t find value in Finance systems beyond the traditional transaction processing and reporting. Almost half of companies are tied to legacy systems, either by choice or the inability to find a way to migrate away from them. Even if Finance systems are to be upgraded, ignorance is still holding them back.

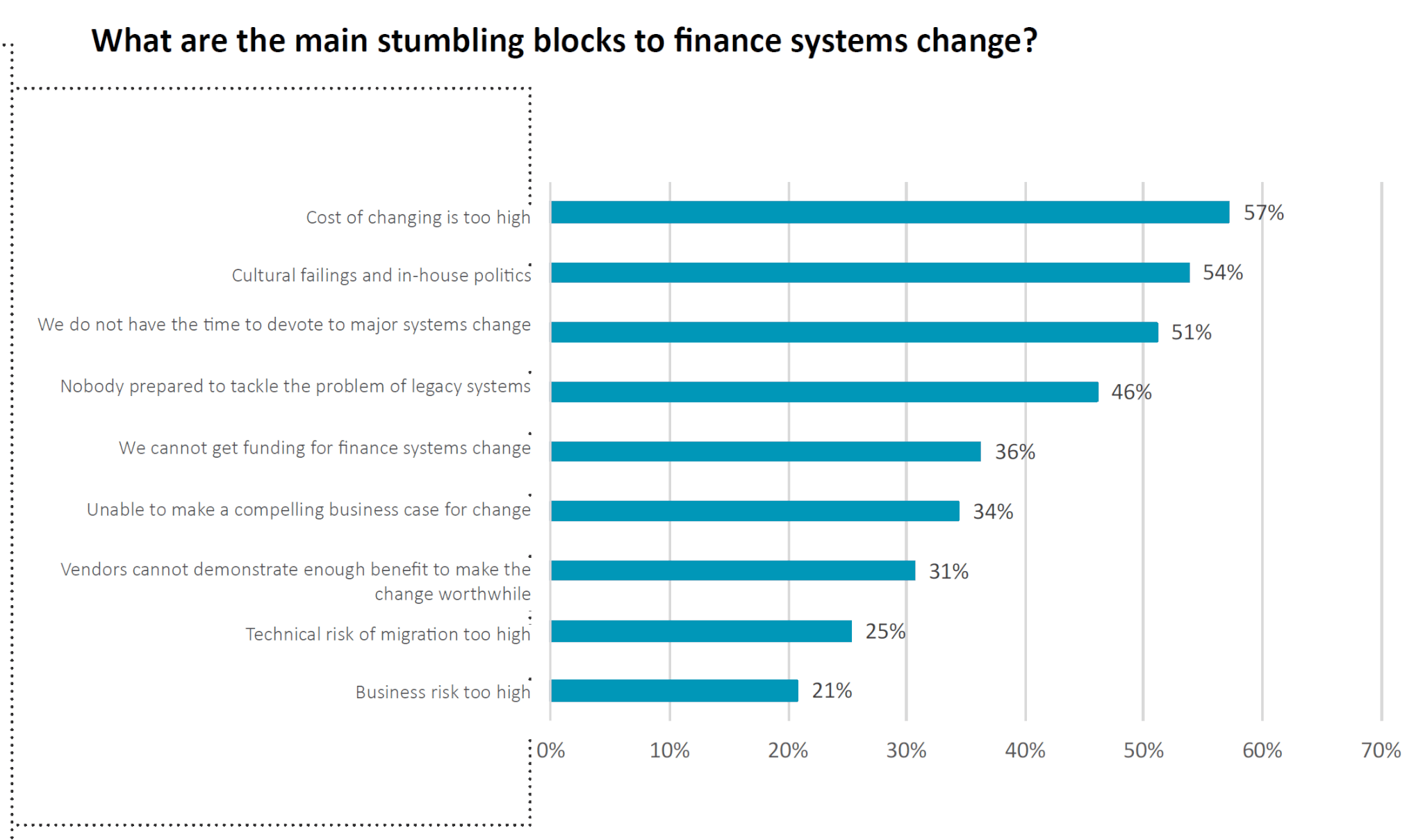

The survey found that 30% of CFOs say they don’t have a good understanding of the solutions in the market and 40% are struggling to understand the different technologies available. And of course, 57% site the cost as too high to make the change, and struggle to justify a significant investment in Finance systems. (figure 1)

Figure 1 – The Main Stumbling Blocks to Finance System Change

Expectations of Future Finance Systems

Despite the hurdles to change mentioned earlier, 84% of survey respondents said they would relish the opportunity to lead or be part of an impactful Finance transformation project. And almost 50% of CFOs are ambitious enough to leave their organization to become more involved in digital innovation in the Finance function, and another half would like to be more innovative but rarely get the time, funding or support to invest in Finance process innovation.

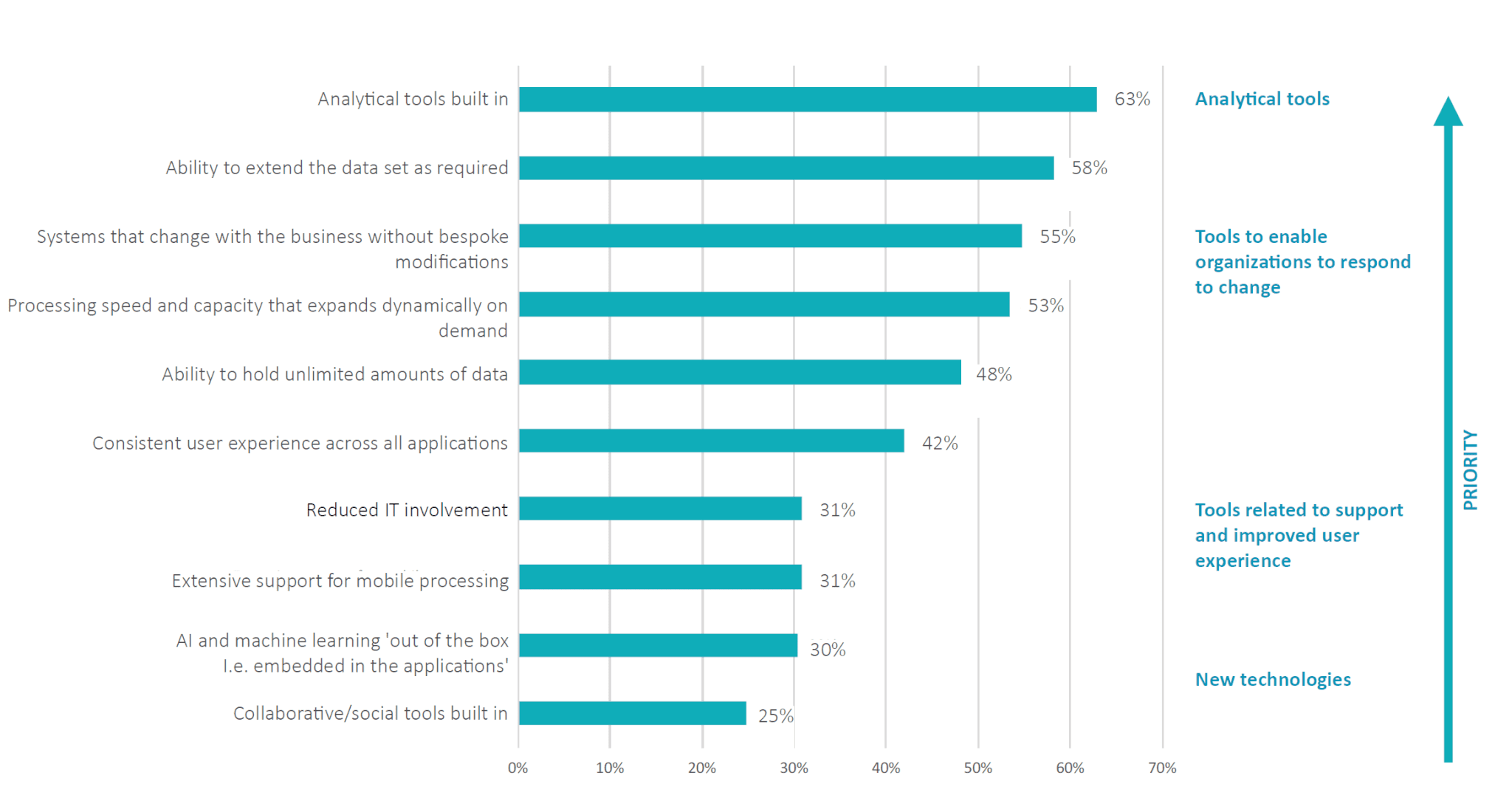

When the decision is made to change Finance systems, the most important characteristic according to 63% of survey respondents is for Finance systems to have built-in analytical tools. This will enable them to improve their insight and take a step up from transactional processing to something that adds more value.

The next most important characteristics all relate to the Finance system’s ability to respond to organizational change. This includes being able to extend data sets, according to 58% of respondents, and enabling change without custom modifications – which was central to 55% of senior Finance executives. 54% felt that processing speed and capacity should be able to expand dynamically on demand, and 48% viewed the ability to hold unlimited amounts of data as an important characteristic of any future Finance system.

Surprisingly, Artificial Intelligence and Machine Learning, as well as collaborative or social tools, were the lowest priority on CFO’s future Finance system ‘shopping list’. Realistically they recognize that these technologies are going to grow in popularity and necessity, but it’s still early in the evolution and they prefer to focus on immediate needs.

Figure 2 – Key Characteristics for Future Finance Systems

Figure 2 – Key Characteristics for Future Finance Systems

Driving Change

According to the FSN survey, just over half of organizations have no plans to replace their Finance systems over the next three years, however 31% of organizations have a fully developed strategy for Finance transformation for at least the next three years. 88% of respondents said the main driver for replacing their current systems would be opportunities for process standardization and automation.

The second key driver which was important for 63% of CFOs was competitive pressure and the need to use Finance transformation to innovate and stay agile and current. This is the next stage in the Finance evolution, when new technologies build on standardized processes to add strategic insight and value.

Strategic change is clearly the key driver of change, but on a more practical level, the end of maintenance and support for legacy systems would be the crunch point for 60% of respondents. And the high cost of maintaining legacy systems was a compelling reason to replace old systems for around half of CFOs.

Finance in the Cloud

According to the survey, and having accepted the cloud as the future, just over half of CFOs expect to have  the majority of their systems in the cloud within five years and 29% expect it all to be in the cloud by then. Just 17% said the cloud had failed to deliver on the benefits they were expecting. Those that gained the expected benefits achieved scalability (of users, data volumes and processing power), they saved time on systems maintenance and backups, and gained business agility.

the majority of their systems in the cloud within five years and 29% expect it all to be in the cloud by then. Just 17% said the cloud had failed to deliver on the benefits they were expecting. Those that gained the expected benefits achieved scalability (of users, data volumes and processing power), they saved time on systems maintenance and backups, and gained business agility.

Learn More

OneStream Software is pleased to co-sponsor the 2019 Future of Finance Systems global survey. The results are not surprising and are consistent with what we see in our interactions with current and prospective clients. Organizations who continue to rely on legacy, fragmented software applications for planning, consolidation, reporting and analysis are hindered in their ability to transform finance, become true business partners to the enterprise, and to gain the agility needed to survive and thrive in today’s global economy.

Finance system change is inevitable. The longer companies delay replacing their legacy systems the more at risk they are from obsolescence. CFOs and senior Finance executives need to find the time to explore their options to make informed decisions – and use this knowledge to make a compelling case for Finance systems modernization. Download the FSN report or watch this webinar replay to learn more.

Get Started With a Personal Demo