Today, all organisations require robust systems and processes across all levels to drive performance improvement, achieve operational excellence and sustain competitive advantage in the dynamic environments they operate.

EPM software forms a management layer above all transaction systems providing a level of agility and visibility now critical for any organisation that wants to successfully handle the non-forgiving complexities of growth and change. With an effective management layer in place, organisations can upgrade or replace underlying ERP/GL systems. And it can be done without disrupting critical management processes, such as planning and reporting, during the transition period.

In this blog post, we review the 5 best EPM software solutions for 2024 using our own interpretation of their relative offerings. We only included software that meets the following non-negotiable qualifications:

- Must be present in the Dresner EPM Market Study 2023.

- Earned at least 4.3/5.0 stars on Gartner Peer reviews for either Planning or Financial Close & Consolidation.

- Software offering includes full management of enterprise-wide consolidation, close, financial and operational planning & forecasting.

What is EPM software?

EPM Software solutions are designed to help organisations effectively manage and analyze their performance data to achieve the strategic objectives they have set. An EPM solution integrates and analyzes data from many sources, including, but not limited to, ERP systems, HCM, CRM, and Supply Chain applications, data warehouses, and also cloud and external data sources. The typical management processes included in EPM solutions are: Goal Setting, Modelling, Planning, Financial Close & Consolidation, Reporting, and Analysis.

EPM solutions typically include the following capabilities:

- Planning, Budgeting & Forecasting

- Close & Consolidation

- Account Reconciliations and Transaction Matching

- Compliance & Regulatory Reporting

- Predictive Modelling & Analytics

- AI Financial Forecasting

Ultimately, EPM software provides management with data analytics and insights across multiple operational systems and processes. EPM solutions provide agility in forecasting and strategic planning, reporting, and decision-making. And they help organizations create alignment across the enterprise.

This comparative analysis explores the features and functionalities of 5 leading EPM solutions: OneStream, Oracle EPM Cloud, SAP EPM, Workday Adaptive & Wolters Kluwer CCH Tagetik.

1. OneStream

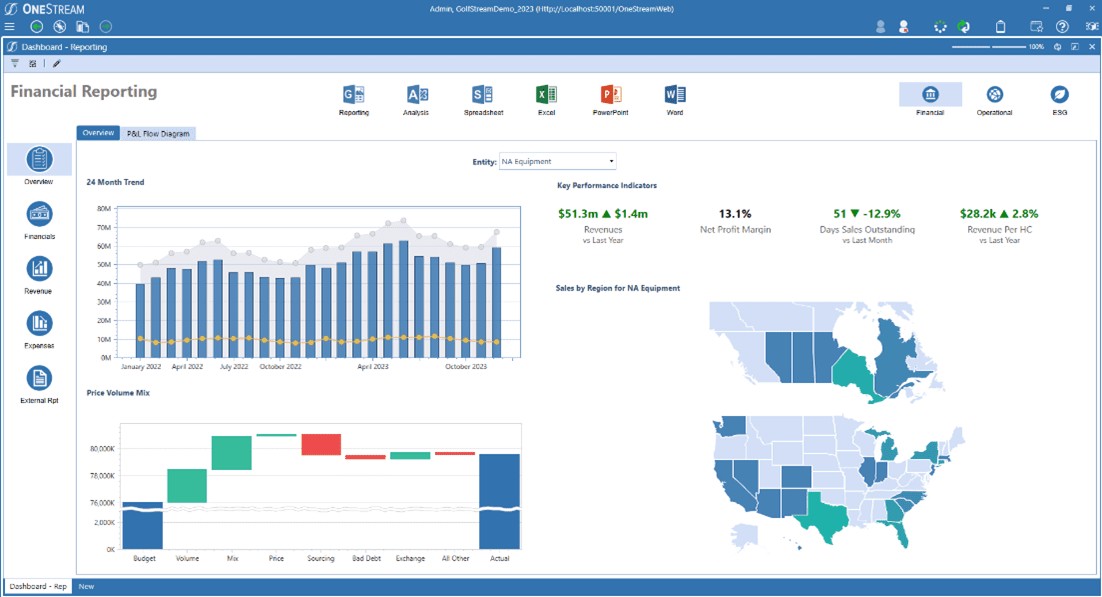

OneStream is the only solution for EPM delivering end-to-end management of enterprise-wide consolidation, close, financial and operational planning & forecasting in a unified platform. This unified platform helps finance, and operations teams collaborate by creating a single source of truth that eliminates the complexity of multiple solutions, interfaces and integrations, cost and duplication of data and metadata, time-consuming processes, and upgrades.

With a built-in data quality engine and pre-built connectors, finance is in control, providing a strong, flexible foundation in data quality that’s ERP and source system agnostic, as real-time as needed, with drill down and drill back to any source, providing auditability across all close, planning, reporting and analysis processes and actionable insights behind every number.

Pros:

- One uniquely unified EPM solution owned by finance for end-to-end management of enterprise-wide consolidation, close, financial and operational planning & forecasting, reporting & analysis.

- Built in data quality engine, providing a strong flexible foundation in integration and data quality delivering confidence, trust and finally, a real one source of truth.

- Built-in self-service reporting, dashboarding, adhoc analysis and deep integration with Microsoft Office in one platform, from balance to transactional details with seamless drill down and drill back to supporting details for transparency, auditability, and actionable details behind every number.

Cons:

- Best for enterprises looking for end-to-end management of enterprise-wide consolidation, close, financial and operational planning & forecasting, reporting and analysis in a unified platform.

- Small to medium size organizations not looking for this unification, while OneStream is user-friendly, mastering the design and advanced features may pose a slight learning curve for these organizations.

- Despite growing popularity, 100% customer success of over 1400+ customers, OneStream may have a smaller but growing market presence compared to a few other alternatives.

2. Oracle EPM

Oracle EPM is a suite of business applications designed for end-to-end management of enterprise-wide consolidation, close, financial planning & forecasting and performance reporting. Oracle is similar to SAP, with legacy solutions from their acquisition of Hyperion with end of support in 2035 for Hyperion HFM and Hyperion Planning. Their suite of applications is being redeveloped on the Cloud, consisting of individual best of breed solutions for each core management process.

Pros:

- A comprehensive suite covering budgeting, planning, forecasting, and advanced analytics, providing the breadth of capabilities for EPM and are well known based on the reputation of Hyperion Solutions

- Integration with Oracle solutions (ERP, HCM, CRM…) and databases, and a robust solution for master data management, data integration and data quality

- A large customer base and global network ensure access to a pool of skilled professionals, services, partners and domain expertise.

Cons:

- Lack of parity in Consolidation & Close solution for consolidation capabilities exists compared to Oracle’s legacy Hyperion HFM solution.

- Fragmented, multiple solutions require multiple complex integrations across solutions to reconcile actuals with plans and to bring in financial and operational data to support the end-to-end consolidation, close, financial, and operational planning, and reporting processes.

- Limited live references and few peer reviews/insights are available for the cloud EPM solutions.

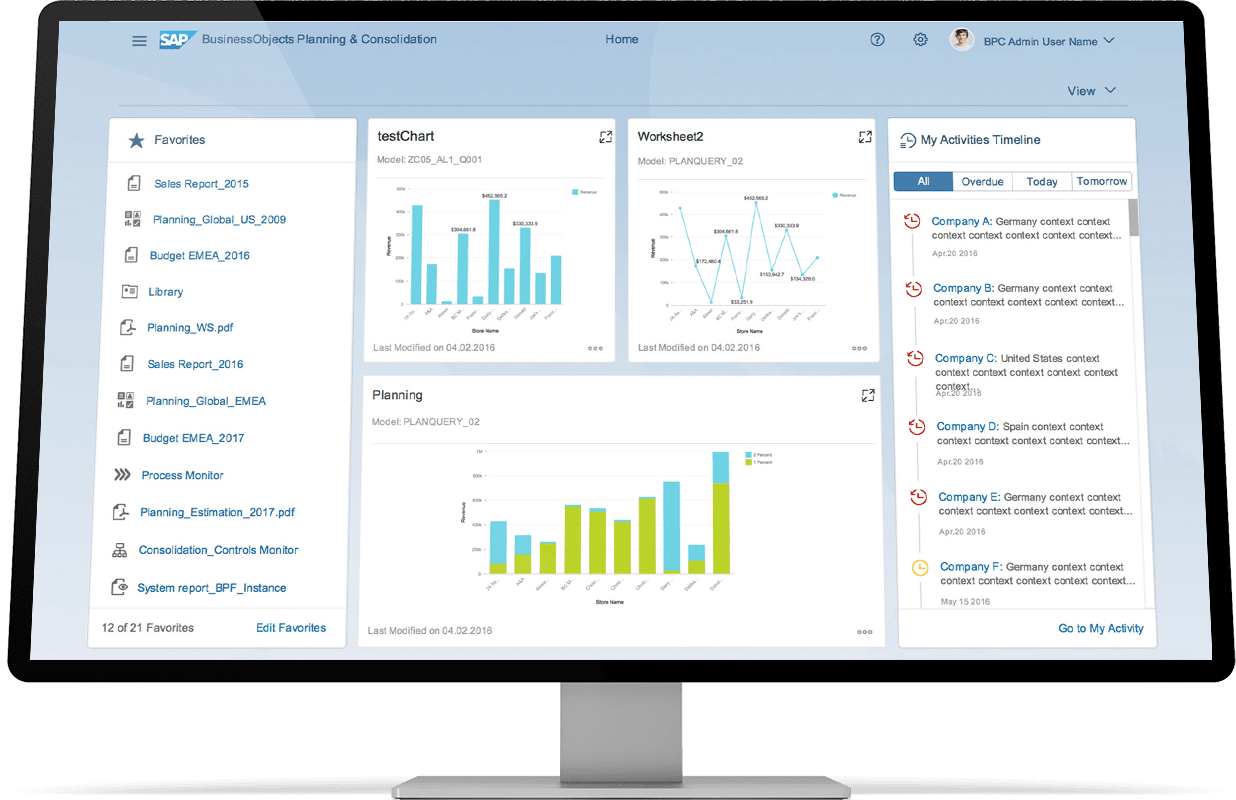

3. SAP EPM

With the end of support of SAP’s legacy EPM solutions – BPC and BFC (BusinessObjects Financial Consolidation) set for 2030, SAP’s go forward solutions for EPM are a combination of SAP Group Reporting embedded in S/4HANA for consolidations and SAP Analytics Cloud for financial and operational planning.

SAP S4/HANA Group Reporting is an enterprise solution for consolidations and since it is part of S4HANA, it leverages a combination of features of Group Reporting for consolidations and S/4HANA for core close capabilities. SAP Analytics Cloud is a cloud-based platform for planning, business intelligence (BI), and predictive analytics, enabling organizations to visualize, plan, and make data-driven decisions.

Pros:

- Both solutions run on the same S/4HANA technology to streamline integration with SAP ERP systems, making it an ideal choice for organizations deeply embedded in the SAP ecosystem.

- SAC offers flexibility in modeling and reporting, catering to diverse business needs.

- SAP customers benefit from SAP’s global footprint, ensuring access to a vast pool of skilled professionals and SAP domain knowledge.

Cons:

- Customers will need to move to S4/HANA and upgrades can be challenging with known impacts on the agility Finance needs to change to Group Reporting for close and consolidation processes.

- Although both Group Reporting and SAC are on S4/HANA, they are still separate solutions, technologies and tools that need to be implemented, integrated, and maintained.

- Requires multiple complex integrations across solutions to reconcile actuals with plans and to bring in non-SAP financial and operational data to support the end-to-end consolidation, close, financial and operational planning, and reporting processes.

4. Workday Adaptive Planning and Consolidation

Workday Adaptive Insight was founded in 2003 as a planning solution with limited consolidation capabilities and acquired by Workday in 2018. It was rebranded initially as Adaptive Planning, but it is now being marketed as Adaptive Planning and Consolidation.

Workday Adaptive Planning covers planning, consolidation, analytics and reporting functions and is built on a proprietary In-memory database enabling collaboration and real time updates in a browser user interface similar to that of a spreadsheet and supports integration of data from ERP and other source systems.

Pros:

- Similar to SAP and Oracle, Workday offers a full stack ERP, Human Capital Management, Peakon Employee Voice, Strategic Source and Adaptive Planning for business process support and CPM/EPM

- End-to-end financial planning process support, covering budgeting, forecasting and strategic planning.

- Intuitive and user-friendly interface, reducing the learning curve for users and facilitating easier adoption across different departments.

Cons:

- Best known as a planning solution, built in consolidation capabilities are weak, especially for complex global consolidations, and limited close capabilities, other than what is built in Workday Financials.

- Fragmented, multiple solutions and technologies require multiple complex integrations across solutions to reconcile actuals with plans and to bring in financial and operational data to support the end-to-end consolidation, close, financial and operational planning, and reporting processes.

- While positioned as a comprehensive set of capabilities, Workday Adaptive has a limited data model for all CPM/EPM processes and has limited data integration capabilities for managing multiple ERP and other source system data integrations needed for all EPM processes.

5. Wolters Kluwer CCH Tagetik

Tagetik was originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally and was acquired by Wolters Kluwer in 2017. CCH Tagetik is marketed as an end-to-end financial close and consolidation solution for group and entity controllers. It is comprised of multiple solutions for financial consolidation and close, account reconciliation and transaction matching, financial and management reporting, disclosure management (via a partnership with CoreFiling), and ESG & sustainability performance management. It is available in both on-premise and cloud.

Of all the vendors in this article, they appear on the surface as the closest vendor to OneStream’s unified platform, but it’s not until you get into the details of how the solutions work together, that it becomes clear it still suffers from some of the same integration and solution complexities as the multiple application approaches of other vendors in the CPM/EPM market.

Pros:

- Better platform approach then other multi-solution approaches like SAP and Oracle, in the CPM/EPM market

- Prebuilt connectors for SAP and SAP S/4HANA and a data quality engine to integrate with ERPs and other data sources, both financial and operational

- Ability to combine balance and transactional data in the platform.

Cons:

- Limited to one cube/model per application, affecting performance, scalability and in most implementations, results in the need to create multiple applications to support CPM/EPM processes – resulting in the same integration and solution complexities as the multiple application approach of other vendors in this article.

- Limitations on data quality, assurance and drill back, resulting in additional steps, time and manual processes to resolve data issues, with no transparency to drill back to source.

- The customer base is strongest in Europe but lacks the footprint in North America of other vendors in this article.

Conclusion

Choosing the right EPM Software is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and to instead evolve to a modern EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best EPM software to handle all your requirements, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in their EPM processes, check out our whitepaper titled: Taking Performance Management to the Next Level with Intelligent Finance

And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperMaximizing Success through Corporate Performance Management in the Modern Business Landscape

In today’s competitive business world, achieving optimal performance and driving business success requires a structured approach. Enter Corporate Performance Management (CPM). Across the organization, CPM provides the tools and methodologies to define, measure, monitor and improve performance.

The definition of CPM, its methods and its key performance metrics are crucial knowledge for modern enterprises. In this blog post, we’ll unveil all 3 aspects. We’ll also highlight a few modern examples of organizations that have successfully implemented CPM in different functional areas to achieve desired business outcomes.

Let’s get started by defining precisely what CPM entails.

What Is Corporate Performance Management?

In essence, Corporate Performance Management is a comprehensive approach to managing business performance, encompassing the entire organization. What does that entail? Setting strategic goals, developing plans, budgeting, monitoring, analyzing data and making informed decisions aligned with business objectives are all part of CPM. By adopting a comprehensive CPM approach, organizations can assess overall performance, enhance performance and drive business success.

CPM addresses the following pivotal questions (among others!):

- Are strategic goals being realized?

- How effectively are resources being utilized?

- What areas demand operational enhancement?

- Are stakeholders receiving adequate value?

Methods in Corporate Performance Management

Now let’s dive into 5 key CPM methods that help drive organizational success.

1. Strategic Goal Setting and Planning

Strategic goal setting and planning is a fundamental aspect of CPM. Why? Through this method, an organization articulates its mission, vision and values. Organizations can also establish SMART goals and devise strategic initiatives. Accordingly, this method aligns activities with strategic objectives, ensures efficient resource allocation and maximizes business performance.

An example of this CPM method in action is Virgin Atlantic’s strategic goal-setting and planning:

- Long-term goal: To make Virgin an industry leader in customer service.

- Actions: Developing strategic initiatives (e.g., launching in-flight Wi-Fi, revamping seat designs and improving entertainment systems).

- Outcome: Increased customer satisfaction and improved financial performance.

2. Budgeting, Planning and Forecasting

Budgeting, planning and forecasting together form another essential aspect of CPM. Why? This method involves preparing budgets based on historical data, future projections and strategic goals. By conducting regular monitoring and variance analysis, organizations can identify deviations and take corrective actions. Effective budgeting and forecasting thus contribute to optimal resource allocation and planning.

An example of the budgeting and forecasting method in action is Coca-Cola’s CPM approach:

- Actions: Employing continuous forecasting and performance tracking against KPIs.

- Outcome: Well-informed decision-making, reduced costs and improved sales.

3. Performance Measurement and Reporting

Performance measurement and reporting involves assessing the performance of departments, processes and business units against KPIs to set objectives. How? By employing performance reports, dashboards and scorecards to help not only visualize KPIs, but also identify areas of improvement and those that require attention. Effective performance measurement and reporting drives successful decision-making and performance improvement.

One example of this CPM method in action is Netflix’s performance measurement and reporting:

- Actions: Using performance reports and dashboards to measure organizational performance against subscriber retention, watch time and content quality – all metrics aligned with Netflix’s long-term objectives.

- Outcome: Data-driven decision-making, improved subscriber satisfaction and comprehensive evaluation of organizational performance.

4. Risk Management

Risk management in CPM involves identifying, assessing and mitigating risks that can impact an organization’s performance. How, precisely, is that achieved? The focus is on developing strategies for risk mitigation, conducting risk assessments and monitoring risk indicators. Effective risk management, in turn, contributes to optimal execution and thus reduces the potential negative impacts on performance.

One example of this CPM method in action is Amazon’s risk management strategy:

- Risks to be managed: Supply chain and logistical challenges, as well as concerns about meeting customer satisfaction levels, when launching Amazon Prime.

- Actions: Implementing a proactive risk management strategy.

- Outcome: Identification of potential areas of risk and actions to mitigate those risks.

5. Continuous Improvement

Continuous improvement involves evaluating and refining processes to enhance overall efficiency, effectiveness and business outcomes. What does that entail? In short, this method involves adapting to changing environments and aligning tactics with evolving strategic goals. Continuous improvement then drives innovation and enhances organizational competitiveness.

One example of continuous improvement in action is Toyota’s KAIZEN methodology:

- Actions: Engaging in continuous process improvement, emphasizing corporate culture and prioritizing employee involvement.

- Outcome: Fulfilled production demands and improved production quality, making Toyota one of the leading car manufacturers globally.

Key Performance Metrics in Corporate Performance Management

Choosing the appropriate performance metrics is crucial for effective CPM. Why? Well, appropriate and effective KPIs enable organizations to evaluate performance, identify areas of improvement and monitor progress toward goals. Below are some common metrics used in different functional areas.

Financial Metrics

Financial metrics are vital for assessing the profitability, liquidity and overall financial health of an organization. These common financial metrics, among others, are used in CPM:

- Revenue growth: Measures the rate at which revenue is increasing over a specific period to indicate the effectiveness of sales and marketing efforts.

- Gross profit margin: Calculates the percentage of revenue left after deducting the cost of goods sold, with a higher margin indicating better cost management and pricing strategies.

- Operating margin: Reveals the profitability of core operations by measuring the percentage of revenue left after deducting operating expenses, indicating the efficiency of the cost control efforts.

- Return on investment (ROI): Measures the return on investment generated from a particular asset, project or initiative to help evaluate the effectiveness and profitability of investments.

- Cash flow: Assesses the inflow and outflow of cash, with positive cash flow indicating healthy liquidity and good financial stability.

By monitoring these financial metrics, organizations can assess their financial performance, identify areas for improvement and make informed decisions to enhance both profitability and financial stability.

Operational Metrics

Operational metrics evaluate the efficiency and effectiveness of an organization’s core operational processes. Why? Essentially, these metrics provide insights into productivity, quality and resource utilization. The following operational metrics, among others, are used in CPM:

- Cycle time: Measures the time taken to complete a specific process or cycle, helping to identify bottlenecks and areas for process improvement.

- Quality metrics: Assesses the quality of products or services delivered via metrics such as defect rate, customer satisfaction score and product/service, which all reliably provide valuable insights into quality performance.

- Production yield: Determines the percentage of units that meet quality standards during manufacturing, helping to detect inefficiencies and optimize production processes.

- Inventory turnover: Calculates how quickly inventory is sold and replenished, with high turnover indicating efficient inventory management, to minimize risk of inventory obsolescence.

- Supplier performance: Evaluates the effectiveness and reliability of suppliers in meeting quality, delivery and cost requirements, helping to optimize the supply chain and reduce operational risks associated with suppliers.

By using operational metrics, organizations can identify process inefficiencies, improve productivity, enhance quality and optimize resource allocation.

Customer Metrics

Customer metrics focus on measuring and evaluating the organization’s relationship with customers. Why? These metrics ultimately help assess customer satisfaction, loyalty and overall customer experience. Examples of customer metrics used in CPM include the following, among others:

- Customer acquisition rate: Measures the number of new customers acquired during a specific period, indicating the effectiveness of marketing and sales efforts.

- Customer retention rate: Calculates the percentage of existing customers who continue to do business with the organization over a given period, with high customer retention rates indicating customer loyalty and satisfaction.

- Customer satisfaction score: Evaluates customer satisfaction via surveys or feedback mechanisms, helping to identify areas for improvement and ensure customer-centricity.

- Net Promoter Score (NPS): Determines customer loyalty and advocacy by measuring the likelihood of customers recommending the organization to others, with a higher NPS indicating stronger customer loyalty and a positive brand image.

By monitoring these customer metrics, organizations can understand customer needs, improve customer satisfaction and strengthen customer loyalty, eventually driving business growth.

Employee Metrics

Employee metrics assess the performance, satisfaction and engagement levels of the organization’s workforce. Why? These metrics play a crucial role in managing talent, fostering a positive work environment and promoting productivity. The following common employee metrics, among others, are used in CPM:

- Employee satisfaction: Measures employee satisfaction and engagement through surveys or feedback mechanisms, helping to identify areas for improvement and assess the effectiveness of HR initiatives.

- Employee turnover rate: Calculates the percentage of employees who leave over a specific period, with high turnover rates potentially indicating underlying issues (e.g., low job satisfaction or ineffective talent management).

- Training hours per employee: Quantifies the investment in employee training and development, helping to assess the organization’s commitment to enhancing employee skills and knowledge.

- Employee productivity: Measures the output or performance of employees in relation to their time and effort, helping to identify high-performing individuals and teams, as well as potential performance gaps.

By tracking and analyzing employee metrics, organizations can make strategic decisions regarding talent management, employee development and overall organizational effectiveness.

Innovation Metrics

Innovation metrics evaluate an organization’s ability to innovate and bring new ideas, products or services to the market. Why? These metrics provide insights into an organization’s innovative capacity and can drive a competitive advantage. Some key innovation metrics used in CPM, among others, include the following:

- Number of new product launches: Measures the number of new products introduced to the market within a specified period, reflecting the organization’s commitment to continuous innovation and ability to generate new revenue streams.

- Research and development investment: Includes the amount of funds allocated to research and development activities, which is essential information for organizations heavily reliant on innovation (e.g., technology companies or pharmaceutical firms).

- Patent filings: Quantifies the number of patents filed by the organization, indicating its ability to protect intellectual property and a commitment to innovation.

By monitoring innovation metrics, organizations can assess their innovation capabilities, identify areas for improvement and foster a culture of continuous innovation.

Conclusion

Ultimately, Corporate Performance Management (CPM) enables organizations to manage performance, align activities with strategic objectives and make informed decisions. With that in mind, here are the key takeaways from this blog post:

- Effective CPM methods (e.g., strategic goal-setting, budgeting and forecasting, performance measurement and reporting, risk management, and continuous improvement) drive organizational success.

- Appropriate KPIs (e.g., financial, operational, customer, employee, and innovation metrics) help manage CPM effectively.

- Success in applying CPM in different functional areas – as shown by Virgin Atlantic, Coca-Cola, Netflix, Amazon and Toyota – helps drive business outcomes and achieve success.

Learn More

For a more in-depth look at CPM in action, check out our Platform webpage – it’s all online, no forms required.

Are you at an enterprise organization looking to upgrade your CPM processes? Get started with a OneStream demo today!

What is Financial Planning & Analysis (FP&A)? At its core, FP&A is a holistic approach to strategic financial management. The approach includes planning, budgeting, forecasting and analysis to secure a company’s health and growth trajectory. FP&A combines financial data, operational data and market insights to provide a systematic view of the company’s current and future financial health.

FP&A requires a deep understanding of the operational dynamics of the business, relevant industry trends and the broader economic landscape. Serving as the architects of financial strategy, FP&A professionals craft detailed plans aligned with the company’s long-term goals and objectives. How? By providing a bridge between the raw data of day-to-day business operations and the strategic insights needed by senior management to make pivotal decisions.

The FP&A team typically reports to the CFO. In turn, the CFO seeks to better understand the current state of the company’s financial position and predict future revenue, expenses, profits and cash flows through data. CFOs therefore often invest in dedicated FP&A software to aid in FP&A analysis.

Why is FP&A so important? What does process entail, and how does it work in action? Keep reading to find out (and to check out some of our industry examples).

The Strategic Importance of FP&A

FP&A’s strategic importance cannot be overstated. In today’s volatile and competitive business environment, the ability to plan effectively, anticipate future financial challenges and navigate strategic decisions with confidence is critical. FP&A provides the foundation for this capability; it offers a comprehensive and forward-looking view of the company’s financial health. Ultimately, FP&A enables businesses to be proactive rather than reactive, positioning them for sustainable growth and success.

What Is the FP&A Process?

FP&A aims to answer important financial business questions. Below are just some of the key questions FP&A teams seek to answer throughout the process:

- What is our breakeven point?

- If revenue declines by 10%, will the company still be profitable?

- What are the financial forecasts for the next year/quarter, and how do they align with strategic goals?

- How do currency fluctuations, interest rate changes and other external economic factors affect financial performance?

- What impact will an acquisition or divestiture have on the bottom line?

- Should we raise debt or equity financing?

- What is the path forward for AI/ML Finance Transformation?

To address these complicated, organization-defining questions, FP&A uses 5 core steps to create comprehensive financial plans and analyses. Typically, these steps come after the long-range planning (LRP) and the annual operating plan (AOP) process.

1. Strategic Planning

The journey of FP&A begins with strategic planning, through which the overarching organizational goals and ambitions are set. As a crucial first step, this stage defines the direction and scope of all subsequent financial planning and analysis efforts. Strategic planning thus involves high-level collaboration with various departments to ensure the financial strategy aligns with operational capabilities and market realities.

2. Budgeting and Forecasting

Central to FP&A is the dual process of budgeting and forecasting. Budgeting involves tactically allocating resources based on the strategic plan to set financial targets for revenues, expenses and capital expenditures. Acting as a financial blueprint, budgeting guides spending and investment decisions over a specific period. Forecasting, on the other hand, extends the vision further into the future using historical data, market analysis and economic indicators to predict financial outcomes. Providing a dynamic view of the company’s financial trajectory, forecasting allows for adjustments in strategy in response to changing market conditions or internal factors.

3. Financial Modeling and Analysis

Financial modeling is another cornerstone of FP&A, providing a framework for analyzing the financial implications of various strategic decisions and scenarios. Through models, FP&A professionals can simulate the impact of different strategies, market conditions and operational changes on the company’s financial performance. This analysis supports risk assessment and thus helps companies mitigate potential financial setbacks and capitalize on opportunities.

4. Variance Analysis and Performance Measurement

An essential aspect of FP&A is the ongoing analysis of the company’s financial performance against organizational plans and forecasts. Through identifying discrepancies between actual results and budgeted or forecasted figures, variance analysis offers insights into why these discrepancies occurred. This continuous evaluation process helps companies refine financial strategies, optimize performance and achieve strategic goals more effectively.

5. Reporting and Decision Support

FP&A culminates in the synthesis and presentation of financial insights to senior management and stakeholders. This stage involves the preparation of detailed reports, dashboards and presentations that highlight key financial metrics, trends and analysis. By providing a concise view of the company’s financial status and outlook, this step supports strategic decision-making and ensures all stakeholders are aligned with the financial objectives.

Examples of Financial Planning & Analysis in Action

To illustrate the real-world application and importance of FP&A, let’s explore a few examples across different industries:

- Technology Startup: For a fast-growing tech startup, FP&A might focus on cash flow forecasting and burn rate analysis. FP&A essentially predicts when the company will need additional funding. By doing so, the process helps the startup plan for capital raising activities and strategically manage its growth trajectory.

- Manufacturing Company: For a manufacturing company, FP&A plays a critical role in capital budgeting and cost control. FP&A essentially analyzes the financial viability of investing in new machinery or entering a new market. By doing so, the process helps the company efficiently allocate resources and maximize ROI.

- Retail Chain: For a retail chain, FP&A is crucial in inventory management and sales forecasting. FP&A essentially analyzes sales trends and market demand. By doing so, the process enables the company to optimize inventory levels, reduce holding costs and plan for seasonal fluctuations.

- Healthcare Provider: For the healthcare sector, FP&A might focus on revenue cycle management and profitability analysis by service line. This process helps the provider understand where to focus efforts to improve financial performance and patient care.

Conclusion

What is Financial Planning & Analysis? As the post above establishes, FP&A is an indispensable business partner and function that helps organizations navigate uncertainty, capitalize on opportunities and mitigate risks. FP&A combines strategic insight with financial acumen, giving FP&A professionals a way to empower companies to make informed decisions and drive sustainable growth. As businesses continue to operate in increasingly complex and volatile environments, the role of FP&A will only grow in importance.

Learn More

Looking to get started with FP&A? Check out our ebook called “Budgeting, Planning and Forecasting.” No form fill required!

Download the eBookIntroduction

Global organizations have relied on SAP BPC (SAP Business Planning and Consolidation) for their financial consolidation and planning needs. Unfortunately, the end-of-support for SAP BPC has been updated and set for 2030. Organizations are thus exploring modern SAP BPC competitors that offer the same capabilities. Yet those alternatives must also meet the challenges of complex global consolidation requirements, broader close capabilities (e.g., account reconciliations), and financial & operational planning scenarios, with the volumes of data needed to support those processes.

Organizations are looking to finally deliver on the promise of one source of truth. To unify the full consolidation and close lifecycle and financial & operational planning with built-in dashboarding, reporting and analysis, from the balance to the transaction level in one solution. Ultimately, the goal is a single solution that meets the requirements of modern organizations and grows with them to meet future requirements.

In this article, we’ll review SAP BPC competitors to examine the key features, capabilities and pros/cons. We aim to give you the information needed to make an informed decision about the right SAP BPC alternative for your organization.

What Is SAP BPC?

SAP BPC was developed to bring together consolidations and planning into one Excel-based interface to ensure familiarity among Finance professionals. With built-in financial intelligence, SAP BPC helped Finance streamline consolidations and produce consolidated Profit & Loss, Balance Sheet and Cash Flow statements. Because of its Excel-based interface, ability to cover multiple planning scenarios and a common data model, organizations were able to run their planning and forecasting scenarios and reconcile plans to actuals for variance reporting and analysis.

With SAP BPC end-of-support set for 2030, many organizations have either already selected or are currently in various stages of selection processes to find SAP BPC alternatives.

To produce this article, we evaluated numerous reviews and analyst reports, which serve as the typical starting point for selecting the right CPM/EPM platform. We then evaluated alternatives based on five key criteria:

- End-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting

- Built-in data quality engine, in the hands of Finance, to provide a strong, flexible foundation in integration and data quality

- Ultimate agility to adapt to varying levels of granularity in the business and across consolidation, planning and forecasting processes

- Optimized end-user experience to drive efficiency and effectiveness, eliminating time-consuming and error-prone manual processes

- Trusted insights from the balance to transaction level with transparency, auditability and actionable details behind every number

Now let’s dive into an overview of the key features, highlights and benefits of SAP BPC for consolidation and planning. To help you find the right solution for your organization, we’ll cover the pros/cons and alternatives. Looking for more information on other top CPM/BPM software? Check out our review: 5 Best SAP BPC Alternatives for 2024.

What Was SAP BPC Used For?

For decades, global organizations have relied on solutions such as SAP BPC for global consolidations and planning processes. SAP BPC had built-in financial intelligence to streamline consolidations so that Finance could produce consolidated Profit & Loss, Balance Sheet and Cash Flow statements. In addition, SAP BPC had built-in planning capabilities (e.g., spreading) to streamline the planning user input during planning processes.

However, SAP BPC never delivered on the promise of one solution. Most customers needed to manage separate consolidation and planning applications. Then, these applications would need to be integrated. Additional applications were often needed to bring everything together for analysis and variance reporting.

SAP BPC Key Features

SAP BPC is known for several key capabilities:

- Financial Consolidation: Facilitates financial consolidation processes, helping companies streamline reporting, eliminate errors and stay compliant with regulatory requirements

- Financial Planning: Enables business planning to create detailed budgets and forecasts, incorporating various factors (e.g., historical data, market trends and business objectives)

- Workflow: Automates workflow processes related to planning, budgeting and consolidation, reducing manual effort and improving efficiency

- Reporting and Analysis: Delivers reporting and analysis capabilities, allowing users to generate customizable reports, perform ad-hoc analysis and gain insights into financial performance

- Data Integration: Integrates with various data sources – including ERP systems, databases and spreadsheets – bringing all financial data for consolidations, planning, reporting and analysis into one solution

SAP BPC Pros

- One application to manage financial consolidation and planning processes

- Built-in financial intelligence and workflows to streamline consolidation and planning processes

- Flexible deployment and integration options with SAP systems and tools

SAP BPC Cons

- SAP BPC is in end-of-support, set for 2030

- A lack of feature parity in future solutions to replace SAP BPC (Group Reporting for consolidations requiring S/4HANA to be implemented first, SAC for planning)

SAP BPC Alternatives

Enterprises today are looking to replace SAP BPC with more modern, cloud-based approaches to CPM/EPM. Many SAP BPC alternatives take the traditional multi-solution approach to CPM, which still results in complex management of multiple solutions, interfaces and integrations. However, solutions such as OneStream unify consolidation, close, and financial & operational planning, reporting, and analysis in one platform.

Enterprises therefore have options to achieve organizational CPM/EPM goals and, with the right choice, can get closer to that elusive one source of truth. The following solutions are the best alternatives for end-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting:

· OneStream

· SAP EPM

· Oracle EPM

· Wolters Kluwer CCH Tagetik

· Workday Adaptive Planning

Conclusion

With the looming end-of-support for SAP BPC, organizations are actively looking for alternatives. OneStream’s Intelligent Finance Platform is the only CPM/EPM solution that delivers end-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting in a unified platform. This platform enables Finance and Operations teams to better collaborate and finally deliver on a single source of truth.

With over 1,400 customers globally, many successful migrations from SAP BPC to OneStream and a mission to ensure every customer is a reference, OneStream stands as the only truly unified platform for CPM/EPM.

Learn More

Want to know more? Check out OneStream’s video about what comes after SAP BPC/BFC/BCS here.

Learn MoreIn the previous post in our “What’s Next for Cartesis/SAP BFC Customers” blog series, we covered how many organisations are now facing the end of support for their Cartesis/SAP BFC application, currently announced for 2027. Of course, this end date could be further extended if significant pressure is placed on SAP. We also looked at some of the concerns/risks. Plus, we detailed 5 key considerations for Cartesis/SAP BFC customers who are moving towards an evaluation process.

Given the above challenges, current Cartesis/SAP BFC customers have 3 options to consider, as outlined in the first post in this series:

- Choice 1: Continue with legacy Cartesis/SAP BFC until support ends.

- Choice 2: Invest in SAP’s unproven next-generation products, such as Group Reporting, Analytics Cloud, Central Finance or some variant hybrid strategy.

- Requires at least one S/4 HANA Finance instance for Group Reporting.

- Requires implementation of multiple fragmented solutions.

- Choice 3: Take control of the Finance Transformation by evaluating alternate EPM strategies such as OneStream.

In this blog post, the focus will be on Choice 2.

Choice 2 – Invest in SAP’s Unproven Next-Generation Products

SAP has chosen a vastly different path than OneStream for the future of SAP EPM solutions. Much like Oracle, SAP chose to continue with the legacy of the past by creating new, separate cloud solutions for each key EPM process area. This suite of applications is still fragmented – rather than innovated towards the future of EPM where all processes can and should exist in one unified platform.

The previous generation of EPM applications was dependent on the technology available at the time. Accordingly, the financial consolidation process was typically built in technology suited to processing data, running calculations and handling non-financial data/commentary. The planning process was typically built using cube technology to handle volumes of data and fast analysis. With the advancements now available, however, separating these processes is no longer necessary. The latest technology can handle the differences in data granularity, differing levels of dimensionality and distinct process steps – all in a single, unified solution.

The different path SAP has chosen results in this current fragmented suite of EPM products:

- SAP Analytics Cloud (SAC)

- SAP Group Reporting

- SAP Group Reporting Data Integrator – tool that gathers financial data from business units

- SAP Datasphere – latest generation of SAP Data Warehouse Cloud

- SAP Fiori – a design system to create specific business applications

- SAP Profitability & Performance Management – separate product for automating all allocation-based business processes

- Account Reconciliations provided by Blackline

- Tax Reporting solution provided by a partner, promoted in SAP Store

- Lease Accounting provided by partner Nakisa

Customer/Peer Reviews

SAP does not have an entry in Gartner Peer reviews for Cloud Financial Close Solutions. Does SAP not consider Group Reporting to be in this category? SAP BFC does appear for financial consolidation, but no reviews have been posted since 2019. The former Outlooksoft product – now SAP BPC also appears but with little focus on close and consolidation, and only 52 reviews have been given in the life of the product.

SAP SAC appears on Gartner Peer Reviews as well – in Cloud Extended Planning & Analysis Solutions with 95 reviews and in Financial Planning Software with 112 reviews. I would expect to see higher numbers given the number of customers SAP claims to serve.

Some of the Gartner reviews include dislikes, as shown in the excerpts from actual reviews:

- “Some of the features in planning that exist in EPM are not yet available in SAC, and user adoption is challenging as users are attached to EPM/BPC”.

- “Insufficient data modelling capabilities, product immaturity, oversold capabilities”.

- “Involves steep learning curve. UI should be more polished and modernised”.

- “Sometimes we want to modify things, and the way to do it is very complicated. It is not user friendly. Simple things like conditional formatting or smart text are very difficult to add”.

- “Reporting/story building and editing is NOT intuitive or user-friendly at all”.

- “Getting started time needs quite some onboarding. User community is not very active, but I guess this is due to the short time of tool availability”.

In contrast, OneStream has 269 reviews in Financial Planning Solutions (4.6 average rating) and 258 reviews in Cloud Financial Close Solutions (4.7 average rating).

Key Considerations

The following key considerations/questions will significantly help facilitate the evaluation process and value assessment when you’re considering what’s next for your EPM solution:

- SAP’s go forward strategy is HANA. The SAP Group Reporting solution relies on underlying HANA technology. Are you being forced to take on the additional cost of implementation and support for HANA?

- For some years to come, the SAP EPM solutions are likely to have limited capability compared to what you’re familiar with in Cartesis/SAP BFC.

- Can your organisation cope with less capability for a period of time?

- Can you count on more capability being delivered in the future?

- The SAP journey is likely to involve significant cost over the life of the application and deliver less. Will you get VALUE quickly from SAP EPM?

- SAP’s core focus is not EPM as the company has many other larger revenue streams. Can you get the service and support you need when the vendor is not specialised in business-critical EPM solutions?

SAP EPM Strategy

I have the greatest respect for SAP’s ERP strategy, and the company has an excellent product – one well-respected by many. Comparatively, the SAP EPM strategy is a very different story. The EPM strategy is not taking advantage of technological advancements which can change the game for EPM solutions by unifying all processes. Regarding EPM & ERP, my best advice when I speak to organisations has always been consistent: the EPM management layer is best kept separate from any ERP. This separation delivers a degree of future proofing for the organisation, and being ERP agnostic leaves room for a lot of flexibility as the organisation evolves and changes over time.

Reasons to Change

Given those considerations, consider joining the more than 300 SAP ERP customers who use OneStream. Below are just some of the reasons these organisations moved to OneStream:

- Ability to replace multiple legacy systems or cloud point solutions with a unified application

- Reduced time, effort and cost to maintain legacy applications

- Fewer manual steps and accelerated reporting and planning

- Support for both corporate and LOB needs in a unified solution

- More flexibility and agility in IT to support the application and extend the solution beyond CPM to CPM+ scenarios like Sales & Operations Planning (S&OP), vendor management, demand planning.

- Shift in Finance staff’s time requirements from admin and manual tasks to value-added analysis

Those reasons highlight why the most natural and capable successor to Cartesis/SAP BFC is OneStream.

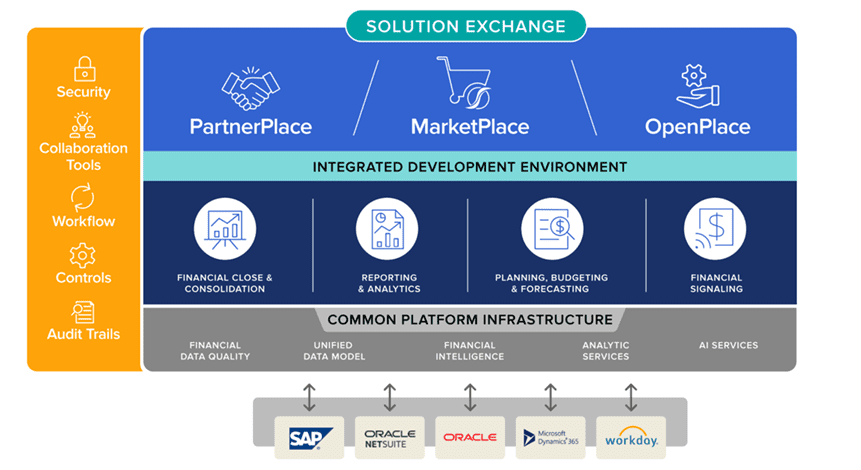

Move Forward with the Next Generation of CPM

OneStream’s Intelligent Finance platform (See Figure 1) is completely agnostic to ERP strategy. Rather than relying on a central ERP strategy, Intelligent Finance platforms integrate data from multiple sources – such as ERP, CRM, HCM and data warehouses – to create a single and governed version of the truth across finance and operational processes.

Figure 1 – OneStream Intelligent Finance Platform

This interoperability is important. Why? It keeps the management layer technology independent from the transactional layers. Any IT department that forces a move to a single tech solution is setting the organisation up for unnecessary costs and delays when future changes occur. After all, you can never say never to changes in your business model or structure.

To learn more about Choice 3 – evaluating alternate EPM strategies such as OneStream – and to understand why OneStream is the most logical move from Cartesis/SAP BFC, tune in for our next and final blog post in the ‘What’s next for Cartesis/SAP BFC Customers’ series.

Learn more!

Ready to join the organisations that have taken the step from Cartesis/SAP BFC to OneStream? Check out our video here, and be sure to visit our website.

In the ever-changing world of modern Finance leadership, the road ahead for Financial Planning & Analysis (FP&A) becomes more defined every day. A significant transformation is taking shape, highlighting the imperative of consolidating connected planning to foster alignment among Strategy, Finance and Operations. Not too long ago, this ambitious vision of seamlessly integrating financial and operational planning faced obstacles due to technological limitations. In fact, the rapid evolution of planning processes often outpaced the capabilities of the supporting technology – a challenge to which many businesses can relate.

However, the undeniable reality is that organizations now find themselves at a critical juncture – either embrace unified connected planning or risk incurring hidden costs.

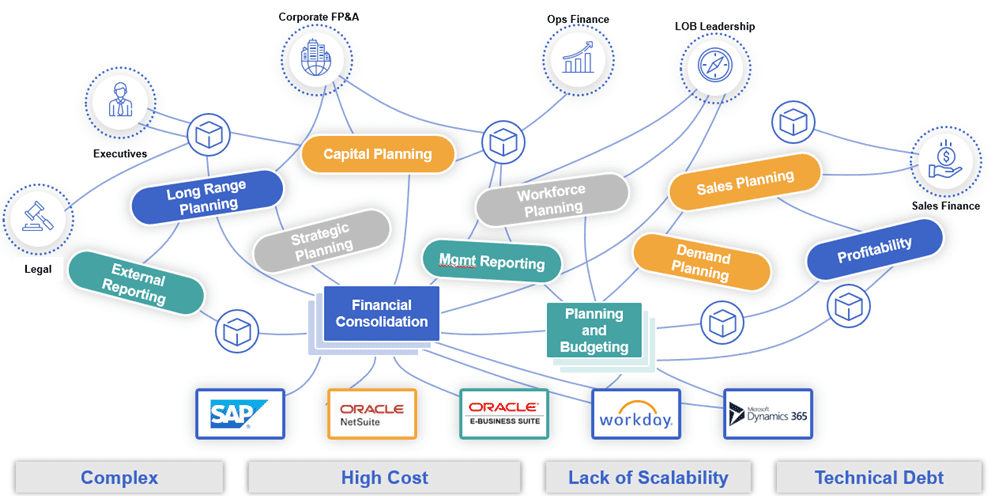

In the world of corporate performance management (CPM), modeling and planning toolkits such as Anaplan, Board and Essbase have been celebrated for their flexibility and speed in addressing departmental planning needs. However, a critical issue arises when these toolkits are tasked with unifying planning processes across an entire enterprise. The fundamental problem lies in the approach employed by FP&A teams, as the toolkits rely on individual planning models that must be interconnected.

That reliance on disconnected models introduces data latency, risks and chaos. The result? A planning process that’s cumbersome, challenging to access, slow to consolidate and prone to inconsistencies. Moreover, the reliance on disconnected models also often leads to user errors and incurs substantial data movement costs (see Figure #1).

Understanding the root of this chaos requires recognizing that these disconnected models primarily serve three purposes:

- Ensuring Consistent Data Collection: The models are often used to maintain data consistency.

- Aggregating Disconnected Data: The models are employed to aggregate data from various sources and systems.

- Inputting Data for Analysis: The data is input into another planning model for in-depth analysis.

The drawback of using disconnected models is the significant amount of time and effort invested in creating and maintaining them. Exacerbating the issue, the models are frequently misused, leading to additional time spent on fixing and consolidating data.

The Hidden Costs FP&A Modeling Toolkits

In today’s corporate landscape, FP&A leaders have a newfound influence, empowered by technological innovations to shift the focus from static back-office tasks to delivering timely, accurate financial and operational insights across the enterprise. However, when contemplating investments to unify connected planning, Finance-oriented CFOs and leaders must consider the common attributes and hidden costs associated with modeling toolkits:

- Data Hubs Created Due to Lack of a Unified Platform: The absence of a unified platform necessitates the creation of data hubs, introducing complexity.

- Endless Design Possibilities and Flexibility: While attractive, flexibility often results in ongoing costs and the need for continuous fixes.

- Data Inconsistencies and Validation: Continuous effort is required to validate data across connected models.

- IT Expenses for ETL and Data Synchronization: Technical deficiencies necessitate significant effort and IT expenses for Extract/Transform/Load (ETL), synchronized models and data repositories.

- Multiple Environments and Data Movements: The need for multiple environments and data movements increases third-party app and data integration costs.

- Monitoring and Repairing Connections: Substantial funds are allocated to monitor and repair the connections between models.

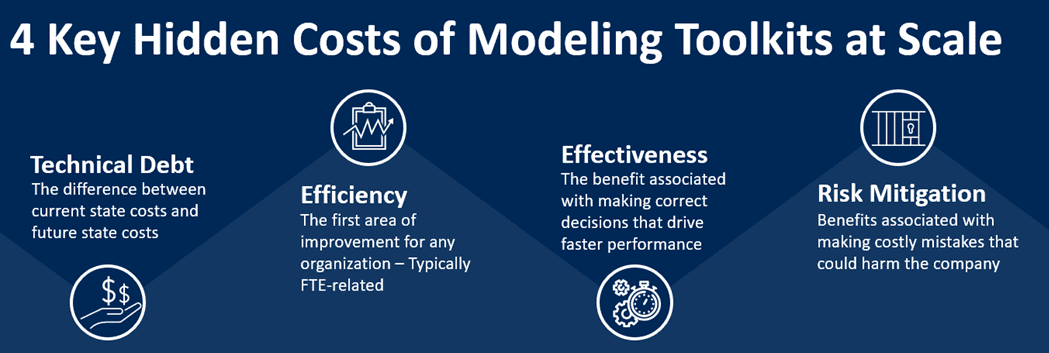

While modeling toolkits are effective for departmental needs, the widespread use of these toolkits across the enterprise planning process generates hidden costs that cannot be ignored (see Figure #2).

Hidden Costs to Consider for Unifying Connected Planning

For FP&A teams aiming to unify their connected planning processes using modeling toolkits, below are four hidden costs that must be considered:

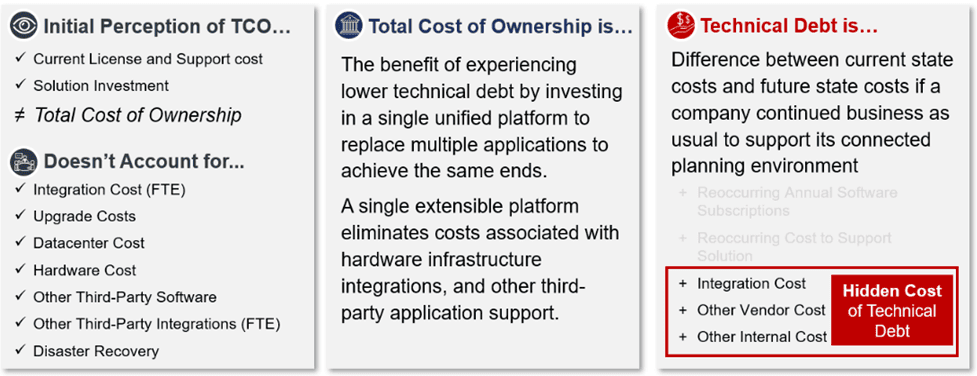

Hidden Cost #1: Technical Debt Is More Than Total Cost of Ownership (TCO)

Scaling connected planning with modeling toolkits often focuses solely on the return on investment (ROI), overlooking the burden of technical debt. Yet implementing a new entity or structure within the organization frequently requires rebuilding modeling toolkits, leading to increased technical debt and higher overall costs (see Figure #3).

Key TCO Consideration

- A good example scenario is an organization that has acquired a new entity that requires tasking the FP&A team with folding the new structure into the current Chart of Accounts (COA). Regardless of complexity, this daunting task will require modeling toolkits – such as Anaplan, Essbase, Oracle Analytics Cloud (OAC) and IBM TM1 cubes – to be either partially or entirely rebuilt. Doing so requires spending time to define and implement the new solution, which will include new data integrations, a new data hub or data warehouse, a new COA, new calculations and new reports.

- The organization may gain some additional insights from implementing a connected planning solution using modeling toolkits, but there would be no reduction in technical debt. In fact, technical debt is more likely to increase and then get labeled as simply the cost of doing business

Hidden Cost #2: Short-Term Gains Erode Organizational Efficiencies

While modeling toolkits offer short-term gains by automating manual processes, using the toolkits can lead to near-term losses for large organizations. These toolkits, despite efforts to connect toolkits, remain fragmented systems that lack scalability, posing a risk to organizational performance.

Key Efficiency Consideration:

- Fragmented Software & Processes – Connected but non-unified Finance solutions require fragmented cubes, modules and sometimes software to support diverse planning processes (e.g., S&OP, sales planning and long-range planning) and offer no solution for insights beyond Finance.

Hidden Cost #3: Forfeiting Effectiveness Is Not an Option

While efficiency gains are enticing, forfeiting effectiveness for the sake of efficiency can be counterproductive. The fragmented nature of modeling toolkits often results in efficient work being applied to inaccurate data, increasing costs as teams seek correct information.

Key Effectiveness Consideration:

- More Data Management & Administration – Non-unified connected planning solutions add technical complexity and administrative burdens on the Finance team – such as moving and reconciling data, constantly managing metadata, monitoring data latency, and managing security between fragmented applications and models. Collectively, these burdens dilute the ability of strategic Finance teams to focus on driving performance and supporting critical decision-making.

Hidden Cost #4: Poor Collaboration Increases Organizational Risks

Collaboration breakdowns related to disconnected data sets can lead to costly mistakes. Only a unified platform can effectively mitigate these risks by ensuring seamless collaboration among departments and applications.

Key Risk Mitigation Consideration:

- Lack of Financial Intelligence – Most modeling toolkits provide no pre-built financial intelligence. What does that mean? It means all the core “financial logic” for monthly financial processes – such as debit/credit account types, hierarchies, dimensionality and currency translation – must be built completely from scratch, which exposes the organization to risk and costs.

Conclusion

Modeling toolkits, despite their merits, also come with hidden costs and complexities that can hinder enterprise-wide planning and performance. FP&A leaders must carefully weigh these factors when considering the adoption of modeling toolkits for connected planning and explore more unified solutions to optimize financial and operational insights across the organization.

Learn More

To learn more about how organizations are scaling connected planning, click here to read our whitepaper on the topic. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions and start your Finance Transformation, let’s chat!

Download The White PaperBuying EPM software is a complex and time-consuming process – one that sometimes becomes a buyer’s nightmare. After all, the process involves managing stakeholder relationships and communicating with multiple software vendors and system integrators. The demands for thinking critically, meeting aggressive deadlines, navigating office politics and making compromised decisions further complicate the process. But overall, software vendors must satisfy the requirements based on very demanding standards to win the buyer’s heart. All those dynamics mean that demonstrating the application is perhaps the single-most important step in the buying process. What, then, does it take for you to get the perfect EPM demo?

Demoing Is Hard for the Buyer and the Seller

Every software demo team wants to hit the mark when it comes to your expectations. But have you ever gazed through the room after a demo and found your colleagues’ facial expressions looking unimpressed or bewildered – basically anything but impressed?

Unfortunately, these situations happen often, for several reasons. To name a few, lack of preparation, misalignment between requirements and capabilities shown, discordant emotional states and more are all possible reasons. Preparing for a demo with the software demo team is therefore key for a successful outcome.

Delivering an EPM demo is pretty much like conducting an orchestra. There is planning, selecting musicians with the right skills, assembling the orchestra, tuning the instruments, rehearsing and more. Then, during the concert the conductor ensures all musicians – the string section, the brass section, etc. – are following the music sheet. Otherwise, all the right notes will likely be played in the wrong order! In a similar way, the demo team needs to plan, understand the requirements, assemble a skilled demo team with influential representatives, rehearse and … rehearse, all to ensure a smooth and enjoyable demo experience for you!

So why, then, can a demo go wrong? Or more importantly, what needs to happen to ensure every EPM demo is tuned to exceed expectations? This post walks you through 3 considerations for a successful EPM demo.

3 Considerations for the Perfect EPM Demo

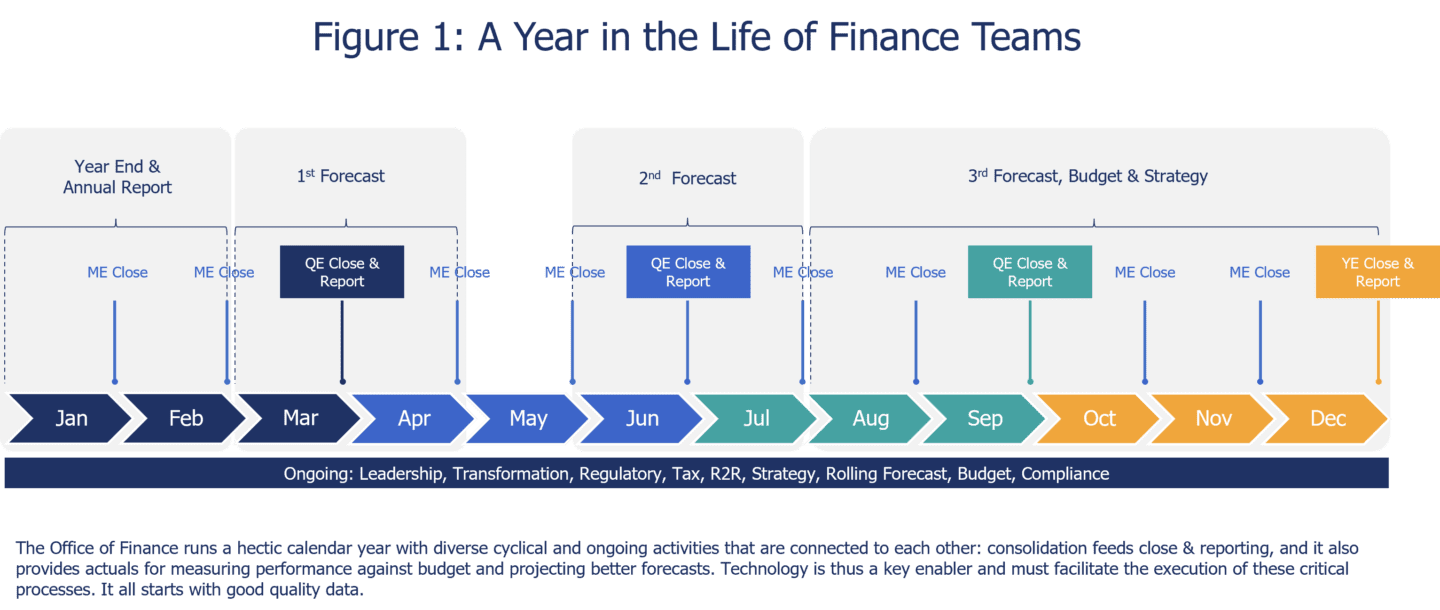

The role of the Office of Finance is evolving to become a trusted business partner that enables and deploys the corporate strategy across the organization. Thus, an EPM solution must support the diverse cyclical processes that Finance teams execute (see Figure 1). The application must also be designed to scale and to accommodate the ever-changing needs from Finance. So when you’re shopping for an EPM solution, it must scale to support the future.

The 3 key considerations below will help you make the most of an EPM demo:

1. Actively engage discovery sessions

A good discovery is key for a successful demo afterward. Demos can go wrong when insufficient time is apportioned to explain your needs in depth. To help ensure things go right, be open to feedback from the vendor’s team and engage in a discussion to level expectations. Discovery is also a great moment to identify risks and start digging up hidden costs:

- Validating the solution scope to avoid risk. The best practice to identify risks is to validate the solution scope together with the vendor. Describe pain points and needs holistically and within the context of the greater Finance processes under which those pains and needs fall (See Figure 1). Consider the flexibility the solution provides to cover all critical financial processes. Especially, revisit the scope if certain future needs can be tackled on the current buying process. Doing so will avoid risk in the long term.

- Surfacing hidden costs. Focus on total cost of ownership and ask questions about not only the infrastructure and third-party applications required to solve for your needs, but also how well the solution can support future requirements.

At the end of discovery, you should be able to answer the following questions:

- Are we aiming for the right scope?

- Are we targeting the right software solution for the problem at hand? Does the software solve for future needs?

- Do we need to adjust the budget due to scope changes?

- Have we agreed to the EPM demo content?

2. Use the demo to further qualify the vendor

Interactions prior to and throughout the demo are a fantastic opportunity for you to further qualify the vendor: is the vendor being professional? Does the vendor understand your industry and business? Does the vendor have the right values and culture? Those questions matter because past behavior is a good indicator of future behavior. Thus, how the demo team works and delivers a demo may reflect the cultural traits on how the company may support you after the solution implementation.

Also, experience has shown that an EPM solution is rarely understood with just one demo, so don’t be afraid of asking for follow-up sessions. In addition, don’t let your current software vendor tarnish the relationship with other vendors or cut down the time needed for assessing other products!

3. Defining the right demo content

Many EPM demos start with a nice-looking dashboard populated with clean data. All very appealing, but how does the data get in there? How easy is to build that dashboard? It is important that key technical aspects are demonstrated. That knowledge will save you many headaches in the future! Accordingly, always request the following points in the demo content:

- Data quality. Knowing how the solution handles and validates the data is quintessential to building one version of the truth between the EPM solution and the source systems where the data resides. Does the solution require loading the same data more than once to support different processes? How easily can you add a new entity structure or a new product SKU? These aspects can hinder the speed at which you can make decisions or add rigidity to business changes, such as M&A activity or expansion into a new market. Learn more about why financial data quality matters.

- Process flexibility. The EPM solution should adapt to your process instead of forcing it to fit rigid workflows. You may be looking for process harmonization opportunities when you replace software, however flexibility will always be required to adopt new business requirements.

- Features and functions. The features and functions are critical since those aspects are why you want to use the technology in the first place. During discovery, you should have clarified your requirements well enough, so now the demo team must show how the solution matches your current needs and future vision.

- User experience. The experience does indeed drive user adoption. But that experience involves much more than just the look and feel. Importantly, you are investing in user adoption when your teams can use one EPM solution for the full range of Finance processes and cover future needs.

- Core Technology. The type of technology can help you decide on the best deployment model (SaaS, PaaS, on-prem), but also informs total cost of ownership by surfacing the hidden costs. Does the infrastructure need ETL middleware or data warehouses? Does it scale to cover your business needs? Is the infrastructure capable of managing FX conversions, multi-GAAP standards, etc. without add-ons?

These aspects require different audiences, so splitting the EPM demo content into more than one session is a standard practice.

Conclusion

Investing time in preparation will help you better qualify the vendors and revisit the scope of each EPM solution to ensure you get the best from your investment. To ensure your EPM demo session is fruitful, clearly communicate your needs and expectations. Also consider the feedback you receive from the demo team to really build the best demo content.

Finally, during the EPM demo, you shouldn’t focus only on the user experience. No matter how easy to use the tool is, adopting it is not a good move if it doesn’t provide the data, doesn’t facilitate the process or people don’t want to use the tool. Adequate demo time must be allocated to prove the EPM solution to ensure it fits the holistic financial process and not just isolated use cases.

Rest assured that every demo team strives to thrill the audience with a stunning demo and end with a room filled with excitement:

Ready for the Next Step?

Meet our expert team of solution consultants, and book a demo of OneStream’s Intelligent Finance Platform.

As modern Finance leaders navigate the turbulent global landscape, the path ahead for Financial Planning & Analysis (FP&A) gets clearer every day. A pivotal shift is occurring, emphasizing the need to unify connected planning to foster alignment between Strategy, Finance and Operations. Not too long ago, however, the ambitious vision of integrating financial and operational planning into a seamless ecosystem faced setbacks due to technological limitations. The rapid advancements in planning processes outpaced the supporting technology – a predicament many businesses might recognize.

But here’s the truth: organizations now stand at a crossroads – embrace unified connected planning or risk incurring hidden costs.

Despite technological advances and increased data accessibility, Finance is still struggling to synthesize all planning across the enterprise into one cohesive and ongoing process. In fact, according to a 2023 report from the American Productivity and Quality Center (APQC), only 26% of CFOs surveyed say their respective company’s approach to annual budgeting is valuable. Plus, even the CFOs themselves admit that improvements are needed

Today’s Finance leaders must maintain board, investor and stakeholder confidence while providing actionable insight to line-of-business managers. To do so, CFOs and Finance managers must, now more than ever, deliver fast, accurate and valuable financial and operational information that can be trusted.

Finance leaders can now leverage modern technology to rid themselves of legacy systems and processes while embracing future trends prevalent in today’s market.

Key Trends Shaping Modern FP&A

Spurred by technological advances, the speed of analytical disruption in organizations is already perpetually fast – and only getting faster. As Finance groups prepare for the transformation ahead, 3 key trends are reshaping the future of how organizations will generate value from reporting and analytics initiatives:

Key Trend #1: The Rise of eXtended Planning & Analysis (xP&A)

As Finance teams respond to a rapidly changing business environment, FP&A is extending its reach to include and collaborate with Sales, Marketing, Supply Chain, Talent Management and IT to accelerate enterprise agility. This unifying framework – known as eXtended Planning and Analysis (xP&A) – enables continuous collaboration and performance management by using a single, composable platform and architecture.

Key Trend #2: More Targeted Analytics

Financial analysts and decision-makers are drowning in complex data. To better process that data, organizations are increasingly enhancing traditional dashboards with dynamic data-driven insights powered by artificial intelligence (AI) and machine learning (ML). The resulting dynamic data stories generate insights as narratives, highlighting the most meaningful changes in the business for each user – with root causes, predictions and prescriptions for the roles and contexts. In turn, the enhanced data-driven insights reduce the risk that financial and operational analyses will be misinterpreted.

Key Trend #3: AI-Enabled FP&A

The way Finance teams manage the data behind dashboards and visualizations is changing. How? Finance can use modern technologies to deploy a host of new models and tools to provide actionable financial and operational data that drive effective decision-making. More specifically, technologies such as ML and AI are leveraged to automate various tasks required during the analytics process – and to discover, visualize and narrate important findings in vast data sets. AI and ML ultimately enable Finance to reduce the time it takes to perform the day-to-day input- and output-focused activities that consume analysts’ time – without requiring the full-time support of data scientists. (See Figure #1)

As organizations navigate the ever-evolving landscape, staying ahead of the curve is paramount to success. While the adoption of modern technologies and embracing key trends can bolster an organization’s financial agility, there comes a crucial juncture when scaling connected planning becomes imperative. Recognizing the signs that indicate the right time for this strategic move can make all the difference in propelling a company towards its goals and sustaining growth.

5 Signs It’s Time to Scale Connected Planning

The continuous sophistication of organizations makes it challenging to harness technology to bolster Finance. When those challenges are coupled with the pressures of volatile revenue streams, Finance leaders are tasked with managing growth, optimizing emerging technologies, addressing globalization demands, evolving target operating models and empowering mobile employees. These leaders must also explore innovative avenues to boost productivity, optimize costs and maximize the value of relationships.

If your organization is evaluating whether it’s ready for Finance Transformation, here are 5 key signs it’s time to scale connected planning.

Sign #1 Increasing Complexity and Data Volume

One clear indicator that it’s time to scale your connected planning efforts is when your organization experiences a significant increase in complexity and data volume. As the business grows, you’ll likely encounter more intricate planning challenges that cannot be effectively addressed with traditional planning methods. Instead, scaling your connected planning capabilities will allow you to leverage advanced analytics and data integration to handle complex planning scenarios, accommodate large data sets and gain deeper insights into business operations.

Sign #2 Lack of Coordination and Collaboration

Disconnected FP&A planning processes often result in silos, leading to a lack of coordination and collaboration between different departments. If you notice your teams are struggling to work together, duplicate efforts or encounter difficulties aligning plans, those signs are a clear indication you need to scale your connected planning efforts. By implementing an integrated planning solution, you can break down departmental barriers, encourage cross-functional collaboration and ensure everyone is working toward a shared set of goals.

Sign #3 Inefficient Planning Cycles

Are planning cycles taking longer than necessary, causing delays in decision-making and hampering your ability to respond swiftly to market changes? If so, those signals are telling you the time is now to scale your connected planning efforts. Automating and streamlining your planning processes through connected planning will reduce manual work, eliminate redundant tasks and significantly speed up your planning cycles. In turn, this increased efficiency allows you to make informed decisions faster and stay ahead of the competition.

Sign #4 Inaccurate Forecasts and Poor Performance

If your FP&A organization is consistently struggling with inaccurate forecasts or failing to meet performance targets, your planning processes may be falling short. (See Figure #2) Scaling connected planning can help you improve forecast accuracy by leveraging real-time data and advanced forecasting models. With access to up-to-date information and robust predictive capabilities, you can make more reliable projections, identify potential risks and opportunities, and take proactive measures to achieve better performance outcomes.

Sign #5 Limited Scalability and Adaptability

As your business expands and evolves, you need planning processes that can scale and adapt accordingly. Traditional FP&A planning methods often lack the flexibility to accommodate growth or respond effectively to market shifts. scaling connected planning enables you to handle increased demand, seamlessly integrate new business units or acquisitions, and adjust your plans to align with evolving market dynamics. Scaling therefore provides the scalability and adaptability needed to support your organization’s long-term growth strategy.

Conclusion

Connected planning is a powerful approach that can revolutionize how your organization manages its planning processes. Recognizing the signs that it’s time to scale your connected planning efforts is crucial for staying competitive in today’s fast-paced business environment. And by addressing increasing complexity, fostering collaboration, improving efficiency, enhancing forecast accuracy and enabling scalability, you can unlock the full potential of connected planning and propel your organization toward greater success. Embrace the opportunity to scale connected planning, and watch your business thrive in the face of changing landscapes.

Learn More

To learn more about how organizations are scaling connected planning, click here to read our whitepaper on the topic. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions and start your Finance Transformation, let’s chat!

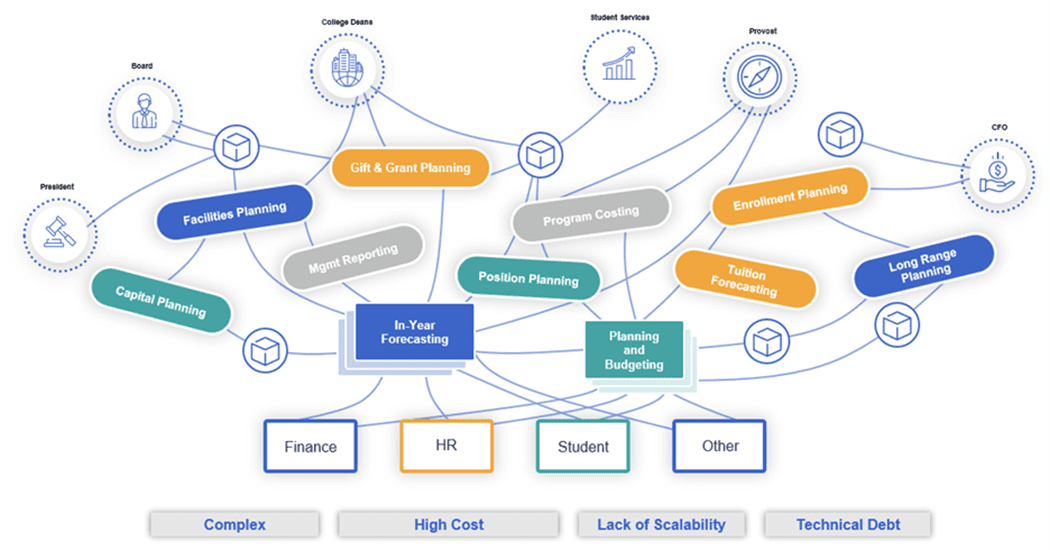

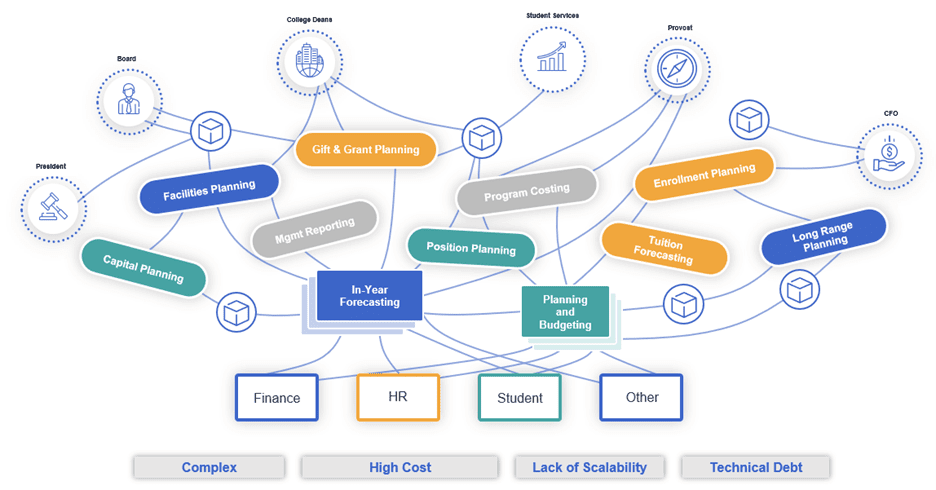

Data analytics is top of mind for higher education leaders, and they are looking to implement changes to transform the use of data across their institutions. However, many are struggling to make the shift. Why? They are up against the challenges of disconnected Finance processes and systems, budget constraints and more. To overcome these, colleges must think bigger and look for long-standing solutions that simplify and maximize business impact. A modern Corporate Performance Management (CPM) solution offers a way to not only break technology and process barriers but also empower Finance with actionable insights.

The Momentum

Data analytics is gaining momentum in higher education. While the past several years have seen a focus on data, the recognition that institutions need to prioritize data now more than ever gets clearer every day. That prioritization can mean supporting data analytics by hiring staff, implementing processes, leveraging new technology and much more. In doing so, making data a priority is becoming more important amid the challenging and competitive landscape in higher education.

In that landscape, Finance and Operations teams deal with the complexity of evolving student needs, workforce requirements, funding constraints and other factors – combined with the pressure to be agile and move quickly. And the best way to manage all of that effectively are tools that provide Finance and Operations with timely, trusted and relevant data.

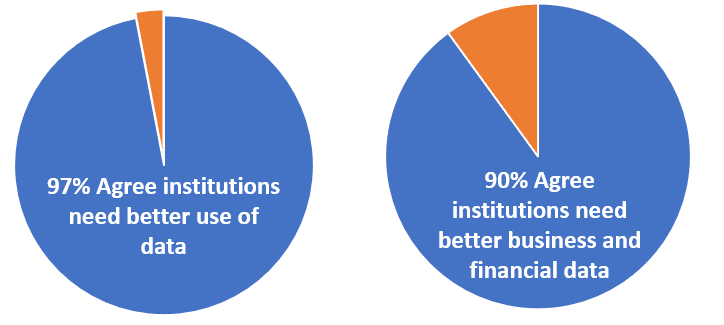

The Chronicle of Higher Education survey1 explored higher education views on the increasing use of data-driven decision-making. According to the survey, most college officials — 97% — strongly agree that institutions need to use data and analytics better to become data-driven institutions (see Figure 1).

Going further, when asked to rate where better data is needed at their institutions, 90% of college officials cited a need for better data in business and financial operations (See Figure 1). This overwhelming agreement emphasizes the acknowledgment of a real need to get people relevant financial and operational data.

However, making the shift to data-centric analysis and decision-making for Finance teams is easier said than done. Why? Universities and colleges must overcome key obstacles to establish changes that will last.

So what’s restricting people from getting the necessary Finance and Operations data?

The Barriers

The survey1 highlighted that culture, tools and processes, and resource constraints represent barriers to progress in data analytics.

According to the survey, the top three barriers to using data are as follows:

- Decentralized/siloed data collection

- Budget constraints

- Trouble turning data into action

Breaking the Barriers

How can Finance teams overcome these barriers with technology?